Heidelberg has acquired the technology, intellectual property, and brand rights of the Polar Group, which mainly makes postpress cutting equipment, but not the company itself.

Polar started off in 1906 as Adolf Mohr Maschinenfabrik (machine factory), Mohr having come from a family of blacksmiths. Originally, the company supplied machinery to the regional timber industry. In 1920, Adolf Mohr pioneered the use of ball bearings in cutting blocks, which keep the blocks from overheating, leading to the Polar name being adopted. After the Second World War, the company was able to expand into the graphic arts market because most of the other cutting machine manufacturers were trapped in East Germany. In 1947, the company introduced its first Polar cutter with an electrical control system, followed in 1949 by the first cutter with an electromagnetic clutch.

Heidelberg immediately recognized the value of this, and so 1949 also marked the start of the long partnership with Heidelberg. Since then, Polar’s history reads like a long list of firsts as the company embraced increasing levels of automation and computerization. It also expanded, setting up Polar Postpress Machinery in China. However, the manufacturing slowdown around the pandemic hit the company hard and by 2023, it fell into insolvency before being acquired by the private equity firm SOL Capital Management GmbH, based in Vienna (which should not be confused with Sol Capital Management Inc, based in the US, which mainly offers financial planning advice to the wealthy). The various companies within the group were reorganized, with Adolf Mohr Maschinenfabrik folded into Polar Cutting Technologies as the main operating company of Polar Group.

The current sale is an asset deal as opposed to the more common share deal. That means that SOL CM still owns Polar Group, but most of the assets that Polar owned have been transferred to Heidelberg. That includes all the IP, know-how, and patents, as well as the brand rights, including the Polar and Mohr names, plus spare parts and stock equipment. Dr. Paul Niederkofler, founding partner and managing director at SOL Capital Management, noted, “The securing of these rights leads to a de facto exclusivity in global sales and service, which will be performed through Heidelberg in the future.”

I believe that under German law, Heidelberg will take over the staff employment relationships. However, the deal does not include Polar’s Chinese subsidiary, which is a company, not an asset. Niederkofler says that production will continue at Polar’s existing sites in Hofheim in Germany, and Shanghai in China.

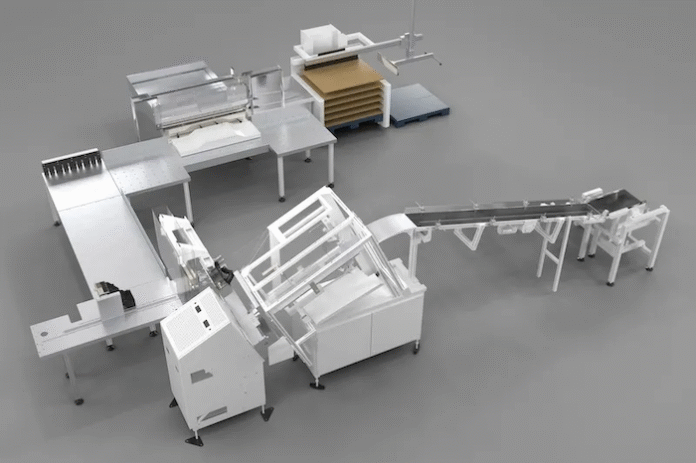

The principal advantage of this asset approach is that Heidelberg will have been able to negotiate which assets it wanted, and to avoid taking on any liabilities (apart from those related to employment contracts). Heidelberg offers postpress systems from Polar as an integral part of its solutions portfolio, so Polar has some value to Heidelberg. The product range includes components and systems that link up and automate all processes – from loading, jogging, cutting, and die cutting through to unloading and banding, as well as some automated label production systems.

That means that whatever value is left in the Polar Group to SOL CM is tied up in its relationship with Heidelberg. Niederkofler told me, “Over the past two-and-a-half years, SOL has been able to strategically refocus the Polar Group on its core competencies and stabilize it in the long term through a far-reaching transformation. We are maintaining this path with a focus on production and construction.”

Niederkofler also told me that he is convinced that Polar still can develop new IP and products, adding, “The agreements between parties secure all future IP to be also exclusively transferred to Heidelberg.”

I asked Heidelberg why it didn’t just buy the company outright, but Heidelberg’s PR team simply forwarded my email to Niederkofler. He replied, “Both parties agreed that Polar Group, under its current ownership, is a strong and trusted development partner and the best counterpart to continue production and assembly activities. This structure ensures both sides can focus on their core strengths.”

In reality, Polar’s deep association with Heidelberg meant that there weren’t many other companies that SOL CM could have sold Polar to. So it’s hard to see this as a long-term arrangement. Heidelberg doesn’t have full control over Polar’s manufacturing, and there’s little reason for SOL CM to invest in its manufacturing facilities. However, it does fit with Heidelberg’s change of focus, from a manufacturer to an integrator. As such, this deal is mainly interesting for what it tells us about Heidelberg’s strategy moving forward.

ürgen Otto, CEO of Heidelberg, commented in a press release, “Heidelberg is aiming to achieve targeted growth through M&A activities in attractive market segments. This acquisition underscores our credentials as a full-range supplier for our customers in the packaging and label industry, including service, and gives us exclusivity in a growing market.”

Otto added, “As a systems integrator, we cover the entire value chain of a packaging print shop – on a fully integrated and networked basis – to ensure production is highly productive. Polar Mohr systems play a key role in this context.”

Readers can find more information on all these companies from heidelberg.com, polar-mohr.com and sol-capital-management.com.