With Heidelberg having the largest installed base of offset multicolor plus coater UV presses in the packaging industry, Klaus Nielsen, managing director of Heidelberg India, in an interview to Packaging South Asia and Indian Printer and Publisher’s Krishanu Dutta, shares his views on the stupendous growth of packaging printing in India. Nielsen also speaks about Heidelberg’s latest strategy in postpress packaging, the expansion of the company’s consumables business and more…

Q: How is the current financial year for Heidelberg India in terms of sales of sheetfed multicolor offset presses? Any perceptible trends such as improved purchasing power of Tier-2 and 3 city printers?

For Heidelberg India the current financial year has been successful in terms of sales of latest technology and to the packaging segment. Among others, we have sold and installed the first two packaging presses with the Inpress Control System. We have installed our first CX102 and XL106 presses, and are just about to start installation of the first Heidelberg press with an in-line foil system. The majority of these presses was installed in and around established printing hubs and each of these presses has given their owners a significant competitive advantage. Our expectations for the future are also positive especially as the Euro has devalued by 20% due to the latest decisions of the European Central Bank.

Q: Do you see a marked or pronounced slowdown among commercial and book printers or do you see this segment as still interested in new presses?

We still see an interest for new presses from commercial and publishing segments in India. The underlying economic uncertainties influenced the investments in such a manner that low-cost, low-automation equipment was preferred. While I understand the risk management of a lower investment point, I still find it concerning that automation is being compromised, in an increasingly competitive environment, where faster turnout of printing jobs is critical for survival. Printers investing in a low-cost, low-automation model will face operational challenges due to job turn-around pressures in the future.

Q: Has the competition from used presses abated; is there more interest in new presses than ever before?

Earlier in the year, the Indian government decided to discontinue the option of importing used equipment under the Export Promotion Capital Goods (EPCG) scheme. This meant that print shops able to generate the required export orders could save 28% on the import duty compared to a used press. Further discussions are under way on ministerial levels to ban used equipment below a certain age, however, I am given to understand that AIFMP is addressing the same. Used presses still carry relevance in the market, but choosing between new or used equipment depends purely on the printer’s investment objective or criteria.

Q: For India we expect the 2014-15 financial year to witness sales of 60 to 70 new multicolor presses. Do you find this a reasonable estimate and how has Heidelberg fared in this regard?

Basically there are two sources for such information, the ‘import statistics’ and us ‘the suppliers.’ While the former is hard to argue against, the latter tends to be overly optimistic. Since the financial year is still not over, I cannot verify the above numbers. But anyway I expect Heidelberg will again be the largest supplier in terms of contract value.

Q: How do you see the monocarton or folding carton market shaping up? How would you describe Heidelberg’s success in this market for 6 color-plus coater and 6 color-plus coater full UV presses?

In the past few years, the packaging segment has been portrayed as the printing industry’s ‘Blue Ocean.’ While this might be true, many print shops have also realized that in order not to drown in the blue ocean, they need a perfect partner like us, who can teach how to swim. While packaging offers opportunities for new entrants, we have also seen green site operations closing down in a short span of time.

Heidelberg India has significant expertise in packaging and UV printing with close to 400 printing units installed in the past six years. I strongly believe that we are the right partners for any packaging printer, who wants to avoid spending 6 to 12 months experimenting in order to gain the required knowledge level to actively compete.

Q: Despite shedding some of the postpress manufacturing, Heidelberg still seems aggressive when it comes to converting machines (diecutters and folder-gluers) for the packaging market. How do you think this will play out in the Indian scenario?

We have made some changes to our worldwide strategy, the most significant of which is of course to sign up with Masterwork Machinery (MK), China. This will give us access to a much wider range of diecutters and folder-gluers, enabling us to very aggressively build on our current installation base. In any case, the Indian market will benefit from having an additional committed quality supplier.

Web-to-Print

Q: About a year and a half ago, you spoke about how the Indian market was still not trusting eCommerce enough for Web-to-Print to take off. Do you think the situation has improved and what are the implications for multicolor offset press sales and sophisticated software to deliver Web-to-Print?

packaging industry

I think that the huge influx of private equity funds into mainstream eCommerce start-ups and repeated massive advertising for the same is changing the perception of eCommerce. We are also seeing a number of Web-to-Print (WtP) businesses growing in the market and I believe WtP providers will significantly impact the market much faster than I would have estimated 18 months back. If the Goods and Service (GST) regime becomes a reality from FY16, another major hurdle for the success of WtP would have been eliminated. Looking at the purchase trend of WtP companies in markets, which has been successfully penetrated by the same — we have seen an increase in demand for larger format presses and significant consolidations among the small-format, one-press print shops without in-house

pre- or postpress facilities.

Q: Do you see the need for multicolor presses aimed at specific markets? What could these be? Is this one of the motivators for Heidelberg’s soon-to-be launched 36-inch press?

In a number of Asian countries, including India, China, Japan and Thailand, the paper mills produce paper according to the old British standards. Also doubledemi size format is mostly preferred among designers, which means a majority of print jobs require a 36-inch press. Since the presence of the above-mentioned countries in the worldwide graphics arts market is growing, it now makes sense to cater to this specific need.

In a number of Asian countries, including India, China, Japan and Thailand, the paper mills produce paper according to the old British standards. Also doubledemi size format is mostly preferred among designers, which means a majority of print jobs require a 36-inch press. Since the presence of the above-mentioned countries in the worldwide graphics arts market is growing, it now makes sense to cater to this specific need.

Heidelberg is planning to launch the Speedmaster CS 92 press in ‘Print China 2015’ this April. The Speedmaster CS 92 is built on the same lines of our successful CD 102 presses. The CS 92 comes with our superior features like Preset plus feeder and delivery, Prinect Press Centre Compact, Alcolor dampening system, Venturi Air transfer system and Autoplate. Enquiries are already coming in for this much-awaited press and we shall start accepting orders from mid-February onwards.

Q: Can you provide an update on your Qing-pu plant?

The Heidelberg assembly plant near Shanghai is doing well. It has now supplied more than 1,500 presses to the Chinese and South East Asian markets. In India, we also have done double digit number of installations from our Qing-pu factory. Looking at the performance of these presses (installed in India) in terms of impression counts and service calls, I must admit that they are doing very well. This is not a surprise when taking into consideration that our Qing-pu machines are made from the same parts we use in Germany, and the fact that we are assembling only standard configured models under strict quality control measures. By the end of the day, it is a Heidelberg printing press and I think the sheer number of presses supplied from our Qing-pu facility is the best evidence to that statement.

Q: Over the past four years Heidelberg India has become increasingly active in the consumables market. Why, and what are your plans going forward?

Our engagement in the consumables business is in line with the group’s overall

strategic agenda. As mentioned earlier, we have, over the years built up extensive

knowledge about sheetfed printing and we wish to use this know-how to offer

quality consumables under the Heidelberg Saphira brand that helps printers to

produce high quality output. At the end of last year Heidelberg bought the European company BluPrint for extending the business with fount and wash-up

solutions. An exclusive offering from us is the GTT technology anilox roller that

enables printers to achieve high gloss prints, while consuming less coating. Our

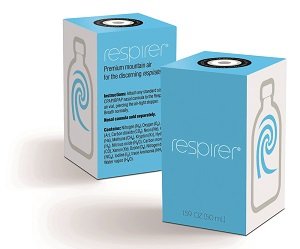

latest initiative is with Organic Coatings (OC), in which Heidelberg India will take

over on an exclusive basis, the sales and distribution of OC’s entire sheetfed portfolio in India. We see huge potential in all three arrangements, but we are particularly looking forward to working very closely with Organic Coatings.”