The Gujarat-based Mamata Machinery, a manufacturer and exporter of pouch-making machines, packaging machines, and extrusion equipment, is the latest entrant in the IPO market – making a strong stock market debut on 27 December, listing with a premium of nearly 147%, against the issue price of Rs 243.

Mamata Machinery’s IPO was subscribed to 194.95 times. On NSE and BSE, Mamata Machinery’s share price opened at ₹600 apiece on 27 December, up 146.91% from the issue price of ₹243. After the debut, the stock hit a 5% upper circuit limit on the exchanges.

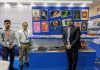

Incorporated in 1979, Mamata Machinery the company provides end-to-end manufacturing solutions for the packaging industry. Products manufactured using its machines are utilized across several countries.

Mamata Machinery, which operates under the brand names ‘Vega’ and ‘Win’, offers end-to-end manufacturing solutions for the flexible packaging industry. Its comprehensive product range caters to both packaging and non-packaging sectors, solidifying its presence across the entire value chain. The company posted a revenue of Rs 236.61 crore in 2024, Rs 200.86 crore in 2023 and Rs 192.25 crore in 2022.

The retail investors booked the issue 138.08 times and employees booked it 153.27 times. The QIBs subscribed to the issue 235.88 times. Mamata Machinery IPO raised ₹179.39 crore by selling 74 lakh shares of promoters and other selling shareholders. The IPO bidding started on 19 December and ended on 23 December. The issue included a reservation of up to 35,000 shares for employees offered at a discount of ₹12 to the issue price. Beeline Capital Advisors was the book-running lead manager of the IPO, while Link Intime India was the registrar for the issue.

The initial public offering of Mamata Machinery Ltd attracted an impressive subscription rate of 194.95 times on Monday, the last day of the share sale. The section for non-institutional Investors saw an incredible subscription rate of 274.38 times, while the allocation for qualified institutional buyers (QIBs) was subscribed to 235.88 times. The portion designated for retail individual investors (RIIs) achieved a subscription rate of 138.08 times.