Flex Films (USA) Inc. is a subsidiary of India’s largest multinational flexible packaging materials and solution company Uflex Limited and has been a regular exhibitor at Pack Expo International. The company concluded a successful 2016 edition that was held in Chicago from 6–9 November. Flex Films is the film manufacturing arm of Uflex with production facilities at strategic locations across the globe like India, UAE, Poland, Egypt, Mexico and USA.

While Flex Films (USA) at Kentucky manufactures BOPET films and has an installed capacity of 30,000 metric tons per annum, Flex Films has an annual production capacity of 337,000 metric tons of myriad packaging films like BOPP, BOPET, CPP, high barrier metallized and speciality films.

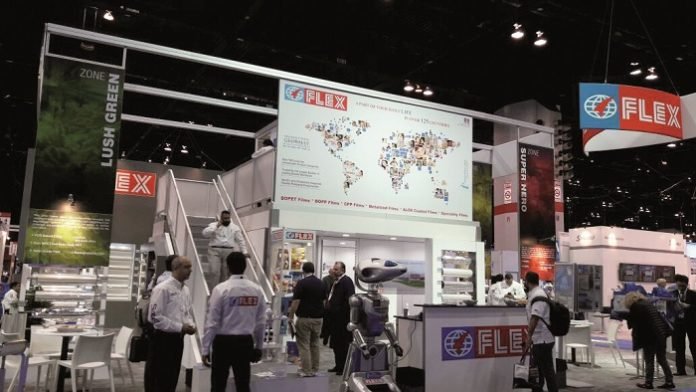

The operations at the US plant started in January 2013. Packaging South Asia caught up with Anantshree Chaturvedi, vice chairman and chief executive officer, Flex Films International at the company’s Pack Expo booth.

“The US plant is a result of our drive for global expansion. We established our plant in Dubai and then in Mexico, Egypt and Poland. It was a natural progression that we established ourselves in the US thereafter,” says Chaturvedi.

Currently, Flex Films (USA) is catering to a mix of flexible packaging convertors as well as industrial users. The flexible packaging sector has about 70% share in the business while the rest comes from the industrial sector.

Talking about the characteristics of the US market, Chaturvedi says that unlike the emerging markets, in the US end consumers drive the technological innovations rather than brand owners or brand managers. “This is a peculiarity of the US market. In emerging markets like India, one needs dynamic hand-holding when it comes to introducing new technology. There the innovation is led by a few big companies, brand owners or convertors who take the lead.”

According to Chaturvedi, there are some interesting trends emerging in the US packaging market. He says that flexible packaging is gaining a bigger market share while rotogravure technology is making a comeback. A lot of organic expansion is happening in the flexible packing segment and many new players are entering the sector.

From the products point of view, he says, high barrier in mono web is gaining popularity, demand for special effect films that enhance point of sale experience is expanding, packaging in general is getting smaller because the US population is ageing and therefore demand for larger pack sizes is decreasing.

Chaturvedi’s advice for Indian players who are looking to establish themselves in the US is that they should focus on quality and be consistent with supply and safety, create a sales force and attend shows like Pack Expo. “It is important to be visible at shows like Pack Expo because it is a fantastic event and if anybody is looking at North American packaging market, then this is the place to be. One can meet every stakeholder across the value chain,” he adds.