Fresh observations from K in Düsseldorf on an industry caught between virgin plastic overproduction, high energy costs and uncertain EPR regulation, by one of India’s young thinkers and a cofounder of recycling company Banyan Nation.

After a week at K Show 2025, one conversation dominated every meeting: the crushing reality of global virgin plastic overproduction. Yet the same industry continues investing hundreds of millions in trade shows and expansion plans while the fundamental economics that sustain recycling collapse beneath our feet.

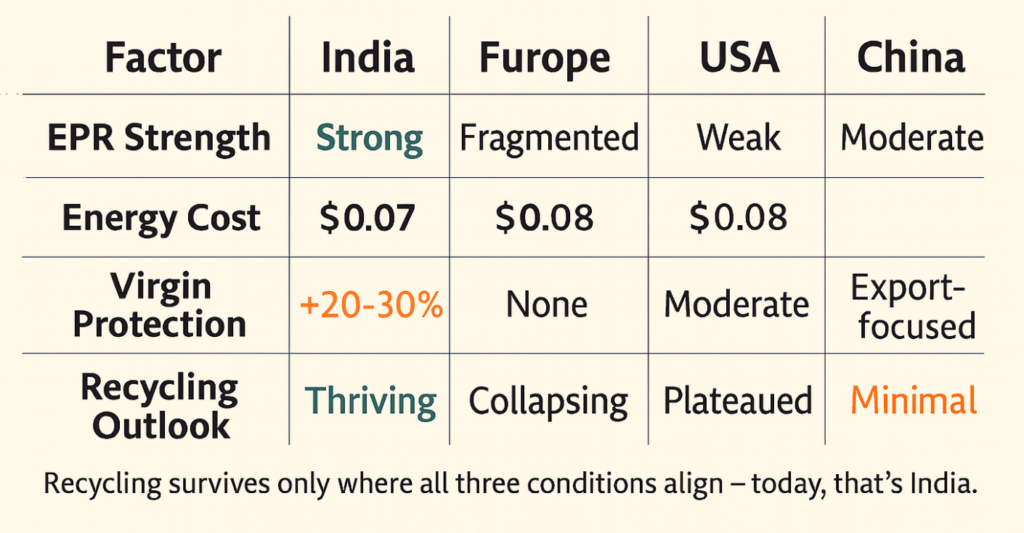

Having spent a decade building Banyan Nation, I’ve never witnessed such disconnect between industry optimism and market reality. Paradoxically, when I analyze the data on the holy trifecta of EPR regulation, energy costs, and virgin price protection, India emerges as the only thriving and investable recycling market in the world today.

It is time for Indian recyclers, Indian brands, the Indian government, and, importantly, Indian investors to seize this unprecedented advantage and build one of the world’s most sustainable recycling economies.

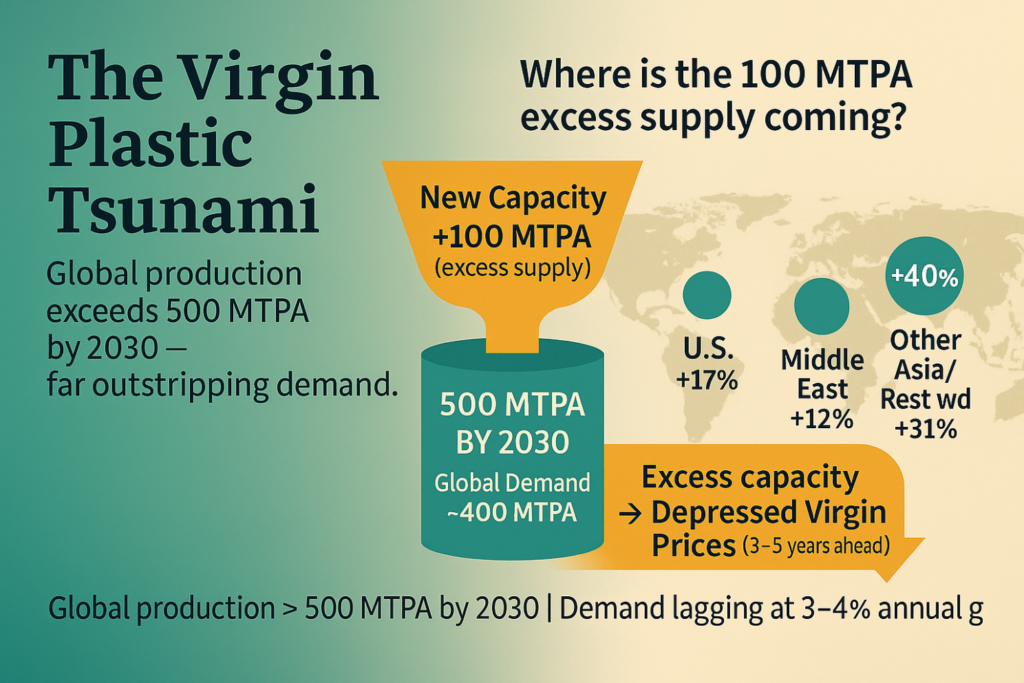

The Universal Anxiety: Virgin Plastic Tsunami

Every conversation—chemical companies, machinery manufacturers, brands, fellow recyclers—surfaced the same concern: the world is about to be flooded with cheap virgin plastic. The numbers are staggering: over 100 million tonnes of new virgin capacity coming online 2025-2030¹ while demand grows at just 3-4% annually. China alone is adding 40% of all global new capacity², with their PP production reaching 127% of domestic demand by 2030³.

Result: Massive oversupply will depress virgin prices for the next 3-5 years minimum.

Why This Kills Recycling Economics

Here’s the brutal arithmetic from my K Show conversations: when virgin prices collapse, recycling becomes economically impossible unless three conditions align:

- Energy costs stay below inflation

- Government subsidizes infrastructure

- EPR regulations force demand for recycled content

Without all three, even technology–driven, cost-efficient recyclers can’t survive—because virgin sets the price ceiling.

This explains Europe’s collapse: energy costs now comprise 50-70% of recycling operations⁴, at $0.18-0.22/kWh vs India’s $0.07/kWh⁵. When virgin becomes abundant and cheap, European recyclers simply can’t compete.

Europe’s Structural Collapse

The European plastics recycling industry is facing “imminent collapse”⁶ with devastating evidence mounting:

- Nearly 1 million tonnes of recycling capacity lost between 2023-2025⁷

- 13.2 million tonnes total installed capacity at risk⁸

- Major UK devastation: Viridor’s £317 million Avonmouth facility closed after just 2 years (Dec 2024), Rochester plant shuttered (July 2025)—Viridor exiting mechanical recycling entirely⁹¹⁰

- Netherlands wipeout: 7 recyclers closed in 2024 alone including Blue Cycle, Cedo Recycling, Stiphout (18,000 TPY)¹¹

- German consolidation: Veolia closed 5 facilities including Rostock (36,000 TPY), plus Bage Plastics, HC Plastics¹²

- Irish casualties: Cloughwater Plastics ceased operations in West Dublin¹³

- Zero net growth forecast for 2025 after years of rapid expansion¹⁴

- Between January-July 2025 alone, almost the same capacity as entire 2024 was lost—three times higher than 2023¹⁵.

- The scale is staggering: Viridor alone represents £317 million in failed investment, with equipment now worth more as scrap than as operating assets. KKR is seeking to sell Viridor for US$ 9.4 billion, signaling broader industry restructuring¹⁶.

India’s Strategic Protection

Indian virgin prices have been 15-30% higher than global prices for over 20 years. This isn’t a weakness—it’s the country’s strategic advantage for the recycling economy.

The Hard Data – Industry data proves this pattern:

- 2021-2022: India maintained US$ 354/tonne HDPE premium (April 2021), US$ 389/tonne PP premium (November 2021) vs China²³

- 2024: China prices hit 31-year lows, India maintained import parity²⁴

- October 2025: India still 14-31% higher across major resins²⁵

India’s Protection Mechanisms

Import duties: 28-30% total landed cost increase (BCD 7.5% + SWS 0.75% + IGST 18%)

Expensive feedstock: 69% naphtha-dependent vs Middle East gas

Government policy: Deliberate protection of domestic industry

Why This Matters for Recyclers

Higher virgin prices create an essential margin for recycled content. Without this 15-30% buffer, Indian recycling would collapse under cheap imports.

EPR: A Vital Lifeline

EPR isn’t policy—it’s recycling’s oxygen supply. Regional differences are stark!

- India: Most comprehensive digital tracking globally. 30% mandates rising to 60% by 2029. Penalties up to ₹100,000 + jail²⁶.

- Europe: Fragmented across 27 countries. Industry relocating rather than complying.

- USA: No federal framework. Limited state initiatives.

Only stringent EPR enforcement can create demand for recycled resin when virgin economics favor cheap supply. Projections show recycling could reach 43% by 2040 – but only with “far-reaching global policies.”³⁰

The Sustainability Payment Problem: Brands and Consumers

The most sobering K Show reality: everyone wants sustainability, nobody wants to pay for it. When virgin costs US$ 800-900/tonne and recycled plastic necessitates US$ 1,000-1,400/tonne, sustainability becomes unaffordable without mandates³³.

Without government intervention forcing environmental cost internalization, market forces alone will never sustain recycling. Current reality: Producing new plastic is often cheaper than recycling³¹, creating a fundamental economic barrier.

The Next Five Years

Virgin prices will stay suppressed as 100+ million tonnes of new capacity come online. European recycling continues a structural decline. US maintains modest growth limited by weak EPR. India emerges as the world’s most stable recycling market—but only with continued government protection and EPR enforcement.

A Decadal Perspective

Building markets in this space taught me that the most profound transformations happen when industries face pressure from multiple directions simultaneously. Today’s recycling faces exactly that—and the winners won’t be the most efficient operators. They’ll be those positioned in markets where governments make recycling economically viable despite virgin abundance.

The question isn’t whether we can compete with cheap virgin on pure economics—we can’t. The question is whether governments will intervene to make sustainability mandatory rather than optional.

After a week of industry conversations, one conclusion is inescapable – successful recycling requires active government support across multiple dimensions:

- Energy subsidies to offset recycling’s intensity

- Import protection preventing virgin dumping

- EPR enforcement creating demand for recycled resins

- Infrastructure support for land, water treatment

- Technology incentives for machinery localization

Without coordinated intervention, virgin overproduction will systematically destroy recycling economics globally.

India’s Historic Moment: Seize the Perfect Storm

While the world struggles with the impossible economics of recycling, India has achieved something unprecedented: all three critical success factors are aligned simultaneously.

This is not an accident—it’s the result of strategic policy choices:

- Protected pricing through deliberate tariff policy

- Strong EPR enforcement creating mandatory demand

- Competitive energy costs providing operational advantage

Three factors determine recycling viability. At the moment, India scores optimally on all fronts.

The Call to Action: Now or Never

For Indian Recyclers: This is your moment. The global competition is being systematically eliminated by economics. Scale up, invest in quality, capture market share while competitors retreat.

For Indian Brands: Source locally. Global supply chains are fragmenting. Build relationships with domestic recyclers who have structural advantages that your international suppliers lack.

For the Indian Government: You’ve created the perfect policy framework. Now double down. Accelerate EPR enforcement, maintain price protection, support technology localization. You’re building a strategic industry advantage that will last decades.

For Indian Investors: The global recycling crisis is India’s opportunity. While European assets sell for scrap value and US ventures plateau, Indian recycling offers a rare combination of policy support, economic viability, and massive domestic market growth.

The Strategic Imperative

The next five years will determine whether India becomes the world’s recycling superpower or just another market flooded with cheap virgin imports. The policy infrastructure exists. The economic conditions are optimal. The competitive landscape is clearing.

The window won’t stay open forever. As global virgin prices eventually recover or other markets fix their EPR frameworks, India’s current advantages may diminish. But today, right now, India has what no other major market possesses: the perfect storm for recycling success.

The question isn’t whether recycling will survive globally—in most markets, it most likely won’t. The question is whether India will capitalize on this historic opportunity to build sustainable competitive advantage while the rest of the world struggles with impossible economics. The time to act is now. The advantage is clear. The opportunity is unprecedented. Let’s build the world’s most sustainable recycling economy—not because it’s good for the planet, but because it’s great for business.

References

1. Global Data Energy, “Asia to dominate worldwide polyethylene capacity additions” (2025)

2. ICIS, “China to add 25% of global polyethylene capacity by 2030” (2025)

3.ICIS Asian Chemical Connections, “China’s PP Export Boom” (2025)

4. S&P Global, “European plastics recycling industry facing collapse” (2025)

5. RH Nuttall, “Industrial Electricity Prices in Leading Economies” (2025)

6. Plastics Recyclers Europe, “Wave of Surging Plastic Recycling Plant Closures Hits Europe” (Sept 2025)

7. Recycling Today, “PRE warns European plastic recycling industry facing imminent collapse” (Aug 2025)

8. S&P Global, “European plastics recycling industry facing collapse: PRE” (Sept 2025)

9. ChemAnalyst, “Viridor to Shut Down its Avonmouth Mechanical Recycling Plant in UK” (Nov 2024)

10. Let’s Recycle, “Viridor to close Rochester plastics recycling site” (July 2025)

11. EUWID Recycling, “Wave of plant closures threatens European plastic recycling industry” (Aug 2025)

12. ChemAnalyst, “Veolia to Shut Down Two Plastic Recycling Facilities in Germany” (July 2025)

13. Circular Online, “European plastic recycling industry facing imminent collapse” (Aug 2025)

14. Parliament Magazine, “What lies beneath the crisis in Europe’s plastics recycling sector” (Oct 2025)

15. Plastics Recyclers Europe, “Crisis in EU Plastic Recycling Demands Immediate Action” (Sept 2025)

16. Recycling Today, “Viridor reportedly up for sale” (Aug 2025)

17. ICIS, “China and the global PP crisis: So much for anti-involution to the rescue” (Oct 2025)

18. ICIS Asian Chemical Connections, “China’s PP Export Boom and the End of an Era” (July 2025)

19. ChemOrbis, “China’s PE, PP new capacity wave gathers pace across Q1 and April” (April 2025)

20. ChemOrbis, “China’s PE, PP new capacity wave gathers pace across Q1 and April” (April 2025)

21. ChemOrbis, “China’s PE, PP new capacity wave gathers pace across Q1 and April” (April 2025)

22. ICIS Asian Chemical Connections, “China’s PP Export Boom and the End of an Era” (July 2025)

23. ICIS, “HDPE and PP prices outside China continue to fall towards China levels” (2022)

24. ICIS, “CFR China PE spreads hit a new record low” (2024)

25. Trading Economics, Plastic4Trade (October 2025)

26. Banyan Nation, “India’s EPR Regulations: Rules, Importance & Future” (2025)

27. Seraphim Plastics, “How the Global Plastic Recycling Industry Is Changing in 2025” (Sept 2025)

28. Seraphim Plastics, “How the Global Plastic Recycling Industry Is Changing in 2025” (Sept 2025)

29. Sustainable Agency, “50+ Recycling Facts & Stats for 2025” (March 2025)

30. Sustainable Agency, “50+ Recycling Facts & Stats for 2025” (March 2025)

31. Sustainable Agency, “50+ Recycling Facts & Stats for 2025” (March 2025)

32. Technavio, “Plastic Processing Machinery Market Size 2025-2029” (2025)

33. IEEFA, “Impact on Virgin vs. Recycled Plastics Prices” (2025)

Copyright Mani Vajipeyajula. Republished by permission of the author.