The bountiful monsoon set to boost rural demand and the GST bill passed in parliament gave hope that 7 to 8% GDP was around the corner. The huge capacity creation in the packaging converting industry in the current fi nancial year is actually part of a long-term growth story. It is almost impossible to create or add to capacity within a single year and it is equally impossible to anticipate demand. As one of our industry friends said recently, packaging capacity has to be looked at as infrastructure and the demand curve will typically follow.

Thus, in all categories such as fl exible and paperboard packaging, labels, semi-rigid, rigid and transport packaging, there has been strong capacity creation in all of South Asia—Bangladesh, India, Pakistan, Nepal and Sri Lanka. New board lines have progressed from trials to series production and market acceptance. Many of the new fi lm lines are aimed at new products and several are wider and faster than before with a huge rise in complexity, automation and optional features to add value.

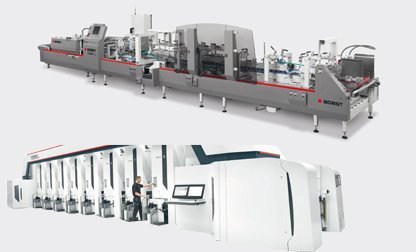

The year has seen an infl ux of around 30 high-quality gravure presses in South Asia, including about a dozen from leading global manufacturers such as Bobst and W&H and the rest from high-quality Asian suppliers including the India-based Pelican, Kohli and Expert. Wide web fl exo presses have been installed in unprecedented numbers from suppliers such as Bobst, Comexi, W&H, KYMC and Uteco, and there are a couple of collaborative projects to manufacture wide web fl exo presses in India by Ufl ex and Manugraph.

The monocarton industry has imported about two dozen highly confi gured 7- and 8-color full UV presses in the current year. The ten leading monocarton manufacturers in South Asia are adding capacity at an almost breakneck pace in anticipation of a strong pickup in future demand. The label industry, which has already undergone some consolidation, has also kept pace. Perhaps the most notable rise in modernization and increased capacity is coming from the corrugated industry. This year has seen some of the larger players investing in European BHS corrugation lines and fl exo printer, converter and gluer machines from the likes of

Emba and Bobst.

Thus, capacity creation continues apace notwithstanding some of the day-to-day disruptions and upticks in demand. However, new entrants and some of the mid-size players in India at least will continue to face challenges because of the recent drop in demand due to demonetization. In the largest economy in South Asia, generally reliable experts are now forecasting a demand recovery to double-digit growth in the August–September 2017 time frame.

Best wishes for the new year!