The Elite Global Summit, spanning two days, serves as a barometer of change. An annual gauge reflecting the state of the global and national economy, the packaging industry, and finally, the health of the flexible packaging industry. It is a good place to evaluate both the progress in plastic and waste regulation and compliance. In addition, there is the perennial search for the magic bullet – innovation and solutions that will show the way to improve margins in a competitive marketplace with thinning margins.

The brand owners say they are caught between the pressure from consumers to lower prices and the rising cost of packaging materials, especially if they are to be sustainable and recyclable. And the packaging converters say they are caught between the rising costs of technology and raw materials, and the brand owners who take advantage of the competition between them. Nevertheless, each year, technology, raw material, and equipment suppliers return to promote their products to the brand owners and converters who attend in large numbers – in the hope of gaining a glimpse of the magic bullet and meeting the ‘right person’ to help them grow their business.

Although some presentations are sales talks, several contain windows to tech change and innovation. Most of all, one encounters progress – the revelation of a problem solved by an early adopter company that is ready to share its development know-how with other brands simply because it sees the benefits of sharing. For instance, the wider use of a new film, adhesive, or coating may lead to bringing down the price of an innovative process or laminate. It will also most likely lead to further innovation.

This was demonstrated by Robert Cotton, the R&D director of PepsiCo, who we met in his previous visit to Elite several years ago, and whose validation on the use of monomaterial laminates for food packaging was among the first that we wrote about. On the first day of this year’s Elite Summit, Cotton spoke first about some of the challenges of paperization and then extensively about biodegradable films, which are still controversial in some regions for lack of clarity in the standard of biodegradability, and for which, in India, there is no accelerated test or certification.

The use of paper for food packaging presents three challenges: it is porous and hygroscopic, and has no barrier or sealing properties; its inherent ‘dead folding’ characteristic deteriorates its appearance as it goes through the supply chain. Secondly, it has sealing, creasing and cracking issues and needs extra thickness to meet repulpability standards.

Lastly, since paper is handled differently from film in recycling systems, it is challenging to establish claims or credits for it. Cotton pointed out that in Europe and the US, it must pass recyclability and repulpability tests to be claimable, and even when these tests are cleared, waste packaging in most countries is generally a mixture of various grades. Thus, although the collection stream for paper packaging exists in most regions, sorting is generally poor, and the tendency to downcycle is likely.

Nevertheless, Pepsi and its numerous industry partners have persisted in creating a technical foundation for ultra-high barrier paper for formed bags. They have targeted two end-of-life solutions in steps – the first being ready to recycle paper with low to medium barrier properties, and the second to come up with ultra-high barrier biodegradable packaging papers.

Progress in barrier and machinability has come from a combination of methods such as dispersion and extrusion coating, metallization, and lamination. Machinability on filling and sealing machines has come from changes in design and critical forming and sealing components. Good progress is reported on a pillow bag format using paper laminated with a very thin, barrier metalized film. The forming and sealing parts of the FFS machine have been modified to minimize the barrier degradation and to improve the seal integrity. Tests are being done on these structures using films that are 3 to 5 times thinner than current metalized plastic structures, with the thinnest film 15 times thinner than the diameter of a strand of hair.

Cotton spoke about developments using biaxial PHA (Polyhydroxy Alkanoae) and PHA-rich blown films that should be 90% biodegradable within six months, after which they should continue to disintegrate. In addition, these materials need to be non-ecotoxic to land and water. A breakthrough multi-layer film structure has been achieved that is fully biodegradable in a backyard or if it is leaked into the soil or marine environments.

This seems like a complex laminate containing a barrier web and a film web with as many as eight layers and as many as ten industry partners contributing components such as polymers, coatings, metalization, sealants, and adhesives. Each of the non-biodegradable components, such as metal, inks, and primer coating, has to be less than 1% of the packaging, and their total cannot exceed 5%. The laminate has passed the TUV tests for home compostability, achieving 90% degradation within 26 weeks and exotoxicity and heavy metal tests for barley and sunflower.

Cotton said that his company is sharing its learning, solutions and patents to help reach scale faster and drive further innovation. “We are sharing our innovations by making our patents available to anyone in the industry. The better the scale of innovation, the better the efficiency. We are advocates for the industry. Join us on the journey.”

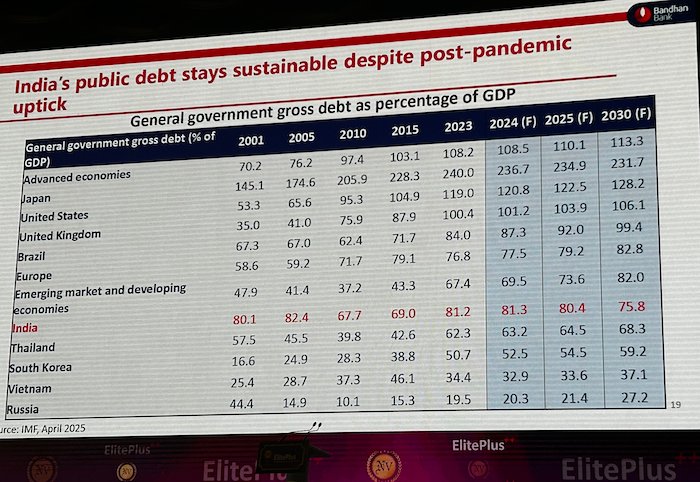

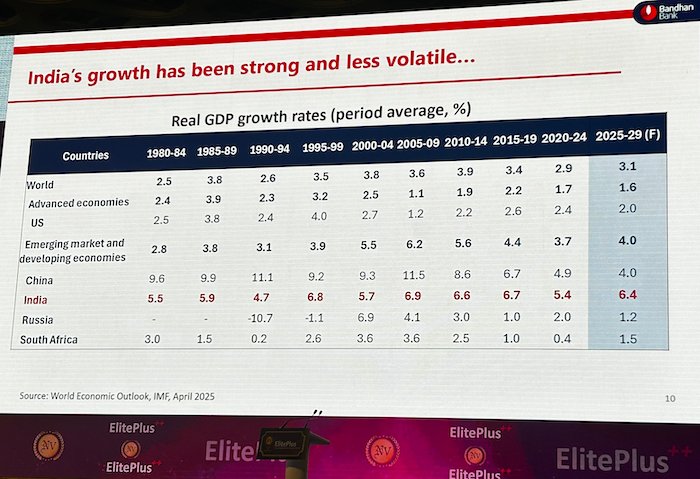

Each year’s Elite Summit contains a morning keynote by a senior banker or investment head that addresses the Indian economy. Siddhartha Sanyal, chief economist and head of research at Bandhan Bank, was surprisingly circumspect despite the government’s numbers showing a remarkable 7.8% GDP growth in the first quarter (April to June) of the current financial year. He spoke about the overall robustness of the economy, which is still consumption-led and in a relatively good situation as far as public debt as a ratio of GDP (India is at 81.3% in comparison to Japan at 236.7%, the US at 120.8%, and the UK at 101.2%).

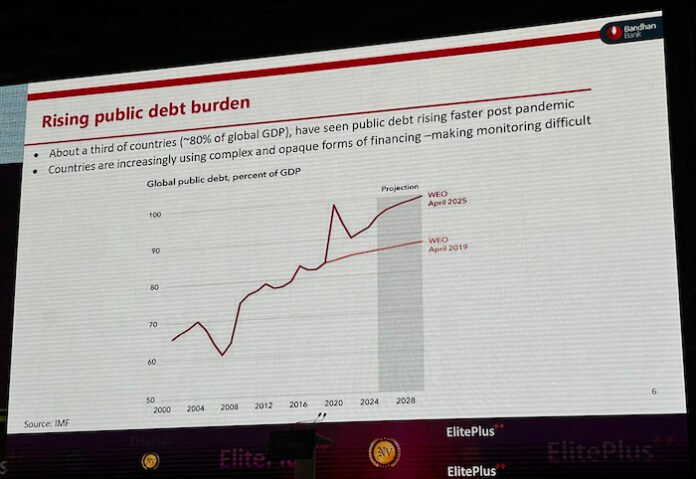

While showing a graph of how the combined global public debt had far exceeded IMF forecasts made before the pandemic, Sanyal warned that this was a structural problem that in combination with trade and tariff wars and slowing fertility, could have “enormous implications for innovation, consumption and growth.”

While wary of the global situation, Sanyal pointed out, “Indian economic growth has come from discipline and fitness – and not from steroids.” Pointing to the country’s debt-to-GDP ratio, which is forecast to continue to decline, the recent moderation of inflation, an expectation of interest rates moderating further, and the improvement in the current account deficit, he said, “I’ll not be surprised if in the coming years we may see a current account surplus.”

Data sets, consumer perceptions, and opportunities

There were at least five or six outstanding presentations and panels over the two days of the global summit, which we will continue to discuss in the coming days. Amongst these are Mani Vajipeyi’s presentation outlining Banyan Nation’s recent entry into the recycling of flexible films and the US$ 4 billion opportunity this presents to the industry at large and the recyclers in particular, in the next five years.

Several outstanding panels addressed the outlook of brands and converters on the new regime of compliance with waste management regulations, including Extended Producer Responsibility, the viability of sustainable packaging, coatings, and adhesives for monomaterials, and sustainable food packaging. An instructive and inspirational panel had five startups discussing their exploration of capital markets.

What emerges from the 12th annual Elite global summit on flexible films and packaging is the relative resilience of the Indian economy and its industry’s willingness to tackle the necessity of innovation, in a world beset by the death and destruction of genocide, tariff and proxy wars over global dominance, and the foretold perils of climate change. As Jacob Duer, president and chief executive officer of the Alliance to Plastic Waste, said at the end of his comprehensive and balanced presentation on the recent and inconclusive Plastic Waste Treaty 5.2 deliberations in Geneva, “India is a country that will lead waste management, plastic pollution, and the circular economy.”

Republished with additional information eron 16 September 2025