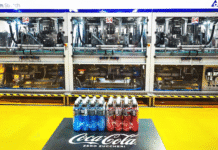

The fourth annual report from WWF’s ReSource: Plastic program has examined the plastics footprints of Amcor, P&G, McDonald’s Corporation, The Coca-Cola Company, and other members – finding a general decrease in their use of ‘problematic plastics’ from 2021 to 2022, although the plastic weight in their aggregate portfolio rose, Packaging Europe reports.

The fourth annual Transparent report looks into the operations of ReSource Members, which also include Colgate-Palmolive, CVS Health, Kimberly-Clark Corporation, Keurig Dr Pepper, and Starbucks.

It records their plastic use by polymer type and form, their adoption of recycled and sustainably sourced biobased content, and the likely waste management pathways for the aggregate portfolio – noting progress made in the allotted time frame and year-over-year results for legacy members.

According to the report, four of the nine ReSource members have reduced their absolute tonnage of plastic since their baseline, while five have increased it.

The total weight of plastic in the aggregate portfolio increased by 0.8% from 7.20 million metric tons in 2021 to 7.26 million in 2022.

However, the members collectively made progress in lowering their usage of ‘problematic plastics’. Such products constituted 1.2% of their portfolios in 2022 – less than half of the 3.2% figure in the 2018 baseline.

Five ReSource members oversaw an overall reduction in virgin fossil-based plastic tonnage between 2021 and 2022.

Members’ use of recycled content rose from 10.2% in 2021 to 12% in 2022, and within the same time frame, the share of recyclable packaging increased from 70.4% to 72.5%.

Transparent 2023 hones in on the elimination of unnecessary plastic, a doubling in global recycling and composting, the shift into sustainable inputs for plastic, and the improvement of data harmonization, measuring progress in each category.

It also collects data surrounding Members’ reuse efforts for the first time in its history. This information hopes to help identify the most effective ways to eradicate plastic waste; all nine members are said to have tried out reuse to some extent, and WWF viewing reuse systems as a ‘key strategy’ in the transition into circularity.

“All companies should be reporting on their plastic footprint—something we are advocating for in the UN Global Treaty to End Plastic Pollution,” said Erin Simon, vice president of Plastic Waste and Business at World Wildlife Fund.

“ReSource Member companies are ahead of the curve, demonstrating that plastic reporting is not an onerous or impossible task.

“Their transparency enables lessons to be learned and actions to be taken that will reverberate across supply chains and industries worldwide.”

WWF asserts that the removal of unnecessary, single-use plastic is the most important action companies can take to tackle the plastic pollution crisis head-on.

Last year’s report recorded a 3,100 metric ton reduction of problematic plastics and a 35% increase in the use of recycled content amongst ReSource members, amongst other figures.

More recently, the environmental disclosure platform CDP saw over 3,000 companies – including Unilever, Johnson & Johnson, and Sumitomo Chemical – disclose information regarding their production, use, and disposal of plastics. Meanwhile, 48 financial institutions signed an open letter calling for corporate disclosure to become mandatory.

First published by Packaging Europe. Reproduced with permission.