As an alternative to smoking cannabis, cannabis-infused sweets are growing in popularity. Though these edibles pose certain challenges for packaging processes, they also offer attractive growth opportunities for the cannabis market. Eric Aasen, Product Group Sales manager – Horizontal, Robotics and Systems Portfolio at Syntegon Technology, discusses some of the most popular trends, production requirements and technological packaging solutions.

Mr. Aasen, many countries and several states in the United States are now legalizing cannabis. What trends can you identify in the market for cannabis products?

Eric Aasen – For a long time, cannabis was forbidden and also taboo in many countries. This didn’t prevent people from using it for medicinal and recreational purposes, although secretly. Thanks to legalization, cannabis is more widely accepted and hence trending around the world. Of course, in certain countries and US states more than in others. Especially in the United States the market is growing, as cannabis was legalized in 2012, initially in Colorado and Washington.

Consumers not only enjoy smoking cannabis, but are also seeking other forms of consumption, including cannabis-infused sweets. These so-called edibles offer relaxation and enjoyment at the same time, and include cannabis-infused chocolate, popcorn, hard candy and gummies. A few years ago, chocolate was favored, but has since taken a backseat to gummies. In the US, gummies made up 60% of cannabis edibles sales in the first quarter of 2021. Other types of cannabis confectionery, such as chocolate, hard candy and taffy, represent less than 25% of the market.

What challenges do edibles pose for production?

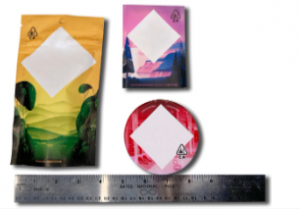

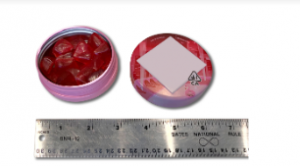

Cannabis products are expensive and often have a short shelf life, so consumers only buy small quantities. Accordingly, edibles manufacturers not only need to package small batches, but to protect the delicate products in the best possible way, e.g. via air-tight packages. Band sealing machines and small flow wrappers lend themselves to these tasks. Band sealers preserve the flavor and help maintain a long shelf life, while flow wrappers have been a mainstay for confectionery packaging for decades, ensuring air-tight seams and processing even small product sizes and batches. The main reason for low production volumes is legislation and correspondingly low levels of automation: since the legal requirements for cannabis production in the United States vary widely, manufacturers – mostly start-ups – have to build small production facilities in individual states, which is a considerable financial burden. As a result, they can’t invest in large-scale equipment, keeping the industry’s automation level low.

What exactly do the US cannabis regulations mean for manufacturers? Can we expect more favorable production conditions once further legalization opens up the market?

Because cannabis isn’t legal in all the US states and there are federal laws that add more complications, companies are not allowed to sell their products or transport their products across state lines. Moreover, federal banks have regulated the payment for cannabis products, urging customers to use cards from state banks or pay in cash. This makes cannabis equipment purchases and sales more difficult. If more states legalize cannabis, we expect to see larger market gains. Companies could scale up production and increase their performance and automation levels. The market still holds great potential.

So, the market conditions are anything but easy. But what about the products themselves? What are the challenges involved in packaging the edibles?

The products are very small and also differ in shape and structure. In addition, they are quite demanding because of their often-sticky texture. Many variants are also coated with sugar, which has a tendency to fall off during the handling and packaging process. This situation adds to the packaging challenges and can lead to package integrity issues if it is not handled properly. An issue like this must be avoided to preserve product integrity and appeal.

Which equipment capabilities can help manufacturers overcome these challenges?

Cleanability is a major factor. Sugar often sticks to the machine parts, disrupting the production process. This calls for properly designed equipment which allows for the fines to fall through without contaminating the mechanical parts. Easy cleaning is another major requirement to keep the equipment and the packagers safe. Product protection, as with all foods, is another priority. Many manufacturers request an integrated gas flushing system to increase the shelf life of the products and keep them fresh. Similarly, packaging machines have to deliver bags with tight seams to prevent product oxidation and contamination with foreign particles.

Product protection is important, but what about preventing misuse by children, for example?

That’s an important point. The packages have to be child-resistant to avoid misuse. At the same time, customers often want resealable bags to keep their products fresh longer. Therefore, machines must be able to produce packaging that combines these two important features.

Speaking of combinations, what about versatility? After all, edibles come in many shapes and sizes.

Given the wide variety of cannabis-based sweets, manufacturers also need flexible platforms that can process products the size of a small breath mint. As I said, the products can be quite small, so machines need to be designed to handle these small products properly. Machines that can be easily upgraded, for instance, to gradually increase the automation of production, are a good choice as well.

How is Syntegon helping to meet these needs?

Syntegon has been supporting manufacturers from the confectionery, chocolate and cookie industries for decades. We are familiar with different product forms and their special requirements, for instance, the handling of delicate products and air-tight packaging. Our band sealing and flow wrapping machines for low outputs can be flexibly adapted to the needs of small and medium-sized companies, including easy cleaning and gentle handling. As companies grow, we support them with matching equipment and automation solutions. With us as their partner, packagers have the comfort of working with a known source. They can be sure we support them with all of their future needs. Compared to manual operations, automation allows them to cut production costs while ensuring operator safety and process safety alike – manual manufacturing poses certain risks of injury, which automated processes can help eliminate.

What else can Syntegon help manufacturers with?

The company offers customized after-sales service, including spare parts management and maintenance from a single source. This sets Syntegon apart from other suppliers, who don’t keep personnel on hand to resolve technical issues. By using our after-sales service and regular maintenance, manufacturers can reduce their spare parts inventory and lower their total cost of ownership. This is an important factor for cannabis start-ups, who need to keep their initial investments manageable.

How do you expect the cannabis market to develop within the next few years?

According to a November 2021 Gallup poll, just over two-thirds of all Americans are in favor of legalizing cannabis. And 60% of adults surveyed in the US by the Pew Research Center in April 2021 feel that cannabis should be legal for both medical and recreational use. Strong public support and the projected market development point to a favorable business environment for cannabis edibles manufacturers – the market research company BDSA expects legal cannabis sales in the US to break the 30-billion-dollar mark in 2022.

What about the European market?

In Europe, the cannabis market is still small because it focuses on medical use. If legislation changes in European countries, we assume that demand for recreational cannabis will rise. We are curious to find out which products will be in demand. In any case, we’re well equipped to meet a wide range of customer needs with our modular machine concept.