Come summer and we reach out for our thirst quencher of choice – be it a glass of frothy lassi, another refreshing sip of mango milkshake or fruit juice, or quintessential Indian summer coolers such as kokum sharbat, aam panna, shikanji, khus sharbat or tangy jaljeera. In the modern era, these traditional drinks that have quenched our thirst on a hot summer afternoon come in handy aseptic liquid packs accompanied with a plastic straw for consumption on the go.

Have you ever wondered how this tiny plastic straw impacts the environment and marine wildlife? According to the WWF website, a staggering 90% of all sea birds and sea turtle species have been found to contain traces of plastic in their bodies, the most common cause being mistaking a plastic straw as a form of food owing to its structurally sound cylindrical shape known to disperse stress from its entire body area. Plastic straws are also accountable for causing laceration injuries to kids while drinking. You would be astonished to know that the plastic straws that we use for a few minutes to sip our beverages and then simply toss somewhere require at least a couple of centuries to partially degrade.

Marine Debris: The Understanding, Preventing and Mitigating the Significant Adverse Impacts on Marine and Coastal Biodiversity report by Convention on Biological Diversity (CBD) says that around 800 different species of marine life are affected by ocean plastic pollution and at least 100,000 marine mammals lose their life each year as a result of plastic debris. Numerous international organizations such as the Plastic Pollution Coalition, Surfrider Foundation, the Last Plastic Straw, Strawless Ocean Program by the Lonely Whale Foundation, and Greenpeace are working to rid our water bodies of single-use plastic straws.

The modern polypropylene-based plastic straw has evolved from predecessors made of metal and stone dating back as far as 5,000 years. The end of World War II saw a boom in plastic manufacturing which in turn popularized plastic-based utensils and cutlery in use today.

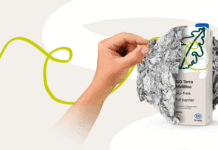

Replacing plastic with paper-based straws

According to Ashwani Sharma, president, and CEO of the Uflex-owned Asepto aseptic liquid packaging business, India manufactures approximately 15 billion aseptic liquid carton packs yearly which roughly amounts to around 41 million packs on a daily average. [Not all of these are the small one-time use packs for beverages.] Sharma says that around 6 billion plastic straws are produced in the country each year, while the remaining requirement is imported. Of the 15 billion aseptic packs produced in the country, Uflex’ Asepto says it produces close to half – that is 7 billion packs in a year for FMCG giants in the dairy, milk based-products, and juice segments.

Juices are the dominant category in the aseptic liquid carton segment, with Coca-Cola, Dabur, Pepsico, and Parle Agro selling close to 60% of their fruit juices in small carton packs attractively priced in the Rs 10-30 price segment. The target demographic is mostly kids, teenagers, and young adults who prefer to have their beverages on the go.

The Indian government imposed a nationwide ban on 22 single-use plastic products in August 2021 (although it was mentioned in earlier waste control orders). The single-use plastic ban that includes plastic straws will come into effect from 1 July 2022. Food service establishments, FMCG giants as well as restaurants are severely impacted by the ban.

There is no question that recyclable and biodegradable paper straws are better for the environment in general and wildlife in particular. Sharma tells us that paper straws cost much more than their plastic counterparts. This, in turn, incurs additional costs amounting to crores for firms selling thirst quenchers in mini aseptic liquid cartons.

Moreover, with the lack of paper straw manufacturers in the country especially the U-shaped straw accompanying many of the mini carton packs of the leading juice brands such as Real, Tropicana, and Maaza, the brand owners have been forced to import paper straws from countries including China, Malaysia and Indonesia and European nations including Finland. Global capacity limitations and stumbling blocks in logistics and distribution may pose problems for the delivery of paper straws imported from foreign countries. These are widely considered much more environmentally friendly as they take from a fortnight to about two months to biodegrade.

Mainstream business media starts to get it!

The brand owners and the plastic lobby of course talk about deforestation and raise the false argument of greenhouse gases produced by the incineration of paper straws rather than the poisonous gasses produces by the burning of plastic straws. They are obviously trying to create conditions in the media for the delay or postponement of the waste control order that bans plastic straws (among other single-use plastics) from 1 July 2022. However, mainstream business dailies such as the Business Standard have finally seen through this tactic and have written strong editorials such as the one 22 June 2022 opposing the postponement of the order.