One of India’s best known packaged food commodities, basmati rice uses flexible packaging for both domestic markets and exports. Packaging South Asia visited India’s largest rice miller and exporter, Khushi Ram Bihari Lal (KRBL), a few miles off NH24 on the road from Ghaziabad to Bulandshahr. With its 120-year-old basmati rice brand, India Gate, the `3,000 crore company is the market leader amongst companies such as Lal Kila of the Amritsar- based Amar Singh Chawal Wale, Dawat of LT Overseas, Kohinoor of Satnam Overseas and Best brands of basmati rice and ready-to-eat delicacies of Best Foods.

The sorted, packaged and branded basmati rice market was initially driven by exports with very little domestic consumption. “We started with a small unit in Alipur in Delhi that used to produce long grain head rice (unbroken basmati) exclusively for the export market,” says Ashok Chand, CEO of KRBL.

KRBL’s second rice mill and plant was established near Ghaziabad in 1998 on an 18 acre site which has since been expanded to 110 acres. “All the head rice was exported in those days while all the broken rice was sold in domestic markets. The head rice yield for raw rice was around 40% to 42% while the head rice yield in the case of par boiled rice was around 50%,” says Chand, a professional engineer who joined the company after a long stint in EIL, Nestle and Pfizer.

“When we started branding the packaged product for the domestic market, the Group chairman, Anil Kumar Mittal, lay down the basic principles – maintaining product consistency and keeping to the committed word at all times. India Gate Basmati Rice owes its leadership to the fact that rice picked up from the store shelves in the Americas is exactly the same as that picked up from store shelves across India. We have various categories like the India Gate Basmati Rice Classic, India Gate Sella (par boiled rice that drives nutrients like thiamine from bran into the grain), India Gate Durbar, Tibar, Mogra and Mini Mogra that are broken rice and segregated under different product classes, but we maintain consistency in each category,” says Chand.

The volume of basmati rice sold in domestic markets has increased manifold due to the processing, sorting and branding and is now equal to basmati exports. At times the price realization in domestic markets is even better than overseas, though in most cases it is at par with the internationally sold product.

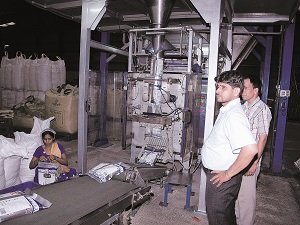

The Ghaziabad mill processes 1,000 MT of paddy a day while the Dhuri rice mill at Punjab processes 2,500 MT of paddy a day. After accounting for the husk which works out to about 20% to 25% of the weight and rice bran which is another 7% to 8% and other wastage, the yield is usually 62% by weight. This is the raw rice that is further classified and sorted in various segments with the high quality head yield of over 40% used for the premium category. The rice husk is used as fuel for the co-generation plant while the bran oil is extracted and sold to oil mills for further refining, packaging and marketing.

Hassia packing lines

KRBL uses packing, filling and sealing machines from Hassia Packaging for bagging 1 kilogram to 10 kilogram bags. Printed flexible packaging material is bought from Huhtahmaki PPL, Paharpur and other packaging suppliers. “We use around 70 to 80 tonnes of flexible packaging material each month in all our plants combined,” says Chand as more and more rice is now being sold in flexible packaging pouches.

Apart from the large KRBL mills in Ghaziabad and Dhur, KRBL is setting up a fully automated plant at Sonepat just North of Delhi for processing and packaging rice from the intermediate stage after de-husking. To be operated by 20 employees, the 500 tonnes per day (TPD) plant will have automated conveyors, handling systems and packing lines.