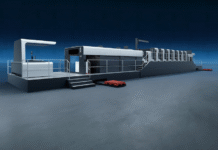

Manroland Sheetfed is a leading global producer of sheetfed offset printing presses and related technologies for commercial, packaging and publishing applications. In India, the company is currently solely into producing, maintaining, and running the sheetfed offset presses, including a product range that covers the entire area right from commercial printing, packaging, and special applications to value additions.

“In the recent times, the market, worldwide and in India, has witnessed polarization, so at the moment the commercial segment in India is pretty down,” says Neeraj Dargan, managing director, Manroland Sheetfed. “Although the demand has gone down worldwide, in India, the packaging companies are investing and expanding there possibilities.”

Today the company is focussing more on the packaging segment. “Our focus area at the moment is paperboard packaging,” says Dargan. “And folding cartons,” adds Vineet Vohra, regional manager of Manroland Sheetfed, who is spearheading the company’s sales efforts in the market. Corrugation is also another packaging area that the company is concentr- ating on according to Dargan.

Customers come first

Speaking on how he is planning to attract better sales, Dargan says, “We practice ‘custom- ers first,’ meaning listening more to customers, understanding customer requirements and are willing to make changes. We have put mechanisms in place to respond to customers’ requirements quickly. Secondly, we have to be flexible to the customer’s demands –not very rigid about what we have. And thus, we are making amends to what we have in our programme of manufacturing.”

Dargan goes on to add, “These value additions are there for the benefit of the customers only, there’s not much that the brand owners would have to pay for. When we are talking about the value additions, they are probably asking me about value additions in terms of coatings, or special effects or foils and more. We believe we should be in the knowledge sharing business wherein customers won’t have to pay a substantial amount. Generally, in India, technology is available but human resources are more important so that’s what we are focussing on right now.”

Although profitable for the past three years, and running as a hands-on company with quick but informed decision-making, Manroland is in a rebuilding phase right now. The company is finding its base after the last four years of absence from the market. “Our internal issues have been sorted out now. In our new organization we have the right people in the right places. We have been able to utilize human resources to their best potential and put all our practices in place. Now we will be able to answer customer queries in the market. It’s not only that we try and make a sales effort, our acceptability in the market should increase,”

comments Dargan.

Manroland has already sold one press in the first quarter of this year. A Roland 200 which is a 4-color press was bought by the Indian government, earlier this year, from Manroland. “In2015,we will be definitely selling atleast one more press in the market,” mentions the confident Dargan.