Today, 28 March, the retail portion of the Creative Graphics Solutions IPO opens for subscription. The anchor portion of the public issue that opened yesterday has apparently received a good response from investors including financial institutions.

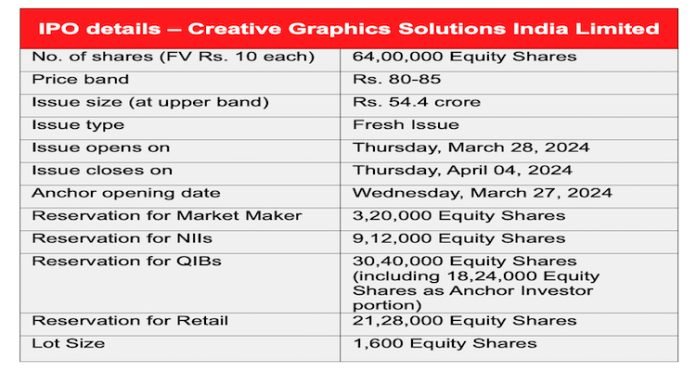

On 22 March 2024, the Noida-headquartered Creative Graphics Solutions India Limited, one of India’s leading organized and integrated packaging ecosystem players, announced that its initial public offering (IPO) will open on Thursday, 28 March 2024. The anchor portion will be opened on Wednesday, 27 March 2024, and the issue will conclude on Thursday, 4 April 2024. The company intends to raise approximately Rs 54.4 crore (at the upper band) from the offering and aims to be listed on the NSE Emerge platform. The price band for the issue has been fixed at Rs 80 to Rs. 85 per share, and the lot size will be 1,600 equity shares.

Corporate Capital Ventures is the Book Running Lead Manager, and Bigshare Services Private Limited is the Registrar for the issue. According to the press release from Creative Graphics, Corporate Capital Ventures Private Limited has completed a string of successful SME IPOs in recent months, including Alpex Solar, Esconet Technologies, Rockingdeals, Accent Microcell, Oriana Power, Droneacharya and Crayons Advertising.

Creative Graphics is a product of the MSMEx SME IPO Cohort program, mentored by Amit Kumar, founder and CEO at MSMEx.

The Noida-based company’s IPO comprises a fresh issue of 64,00,000 Equity Shares with a face value of Rs 10 through the book-building route. As many as 3.2 lakh equity shares are reserved for the Market Maker, 9.12 lakh equity shares allocated for NIIs, 30.4 lakh equity shares for QIBs (including 18.24 lakh equity shares as the Anchor investor portion), and the Retail (RII) portion accounts for 21.28 lakh equity shares.

According to the Red Herring Prospectus document, the company intends to utilise the net proceeds from the IPO to meet the working capital requirements of the company, repay/prepay, in part or full of certain of the company’s borrowings, meet the capital expenditure of the company, fund inorganic growth through unidentified acquisition for the company, and general corporate expenses.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letter press plates, metal back plates, and coating plates. The company serves its customer base in India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities in various states – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited. While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces Alu-Alu Foil, Blister Foil, Tropical Alu-Alu Foil, CR Foil, and Pharmaceutical Sachets.

The company clocked a revenue of Rs 48.07 crore and earned a profit (PAT) of Rs. 7.24 crore during the first half (H1) of the current FY 2023-24 financial year, which ended 30 September 2023. It registered revenue of Rs. 90.14 crore and a profit (PAT) of Rs. 8.64 crore in FY2022-23.

Our take

We have known Creative Graphics for the past decade and have also admired its fast growth in establishing new plants across the country. We appreciate the need for companies in the printing and packaging industry to expand and raise capital for scaling up their operations. Creative Graphics’ team has always been enthusiastic about vertical integration and diversification to new areas of packaging. The company’s IPO will hopefully open a path for other companies in the industry needing to raise capital for scaling up.

For more information, please visit: https://creativegraphics.group/

Disclaimer: CREATIVE GRAPHICS SOLUTIONS LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed the RHP with the NSE Emerge. The RHP is available on the website of BRLM and the website of NSE. Any potential investors should note that investment in equity shares involves a high degree of risk, and for details relating to the same, please refer to the RHP, including the section titled “Risk Factors”, beginning on page 28.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act) or any state securities laws in the United States, and unless so registered, and may not be issued or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with any applicable U.S. state securities laws. The Equity Shares are being issued and sold outside the United States in ‘offshore transactions in reliance on Regulation “S* under the Securities Act and the applicable laws of each jurisdiction where such issues and sales are made. There will be no public offering in the United States.

First published on 23 March 2024, this article has been updated on the morning of 28 March 2024 – editor.