The market survey carried out by PackIOT, in partnership with Instituto das Embalagens (Brazil), 360 Packaging (India and Asia), and People of Packaging (USA), reveals that more than half of the packaging producing industries are unable to point out in a time where are the bottlenecks in the production line. More than 150 packaging industry professionals from over 25 countries participated in the survey, concluding that 12% of companies say that identifying bottlenecks and analyzing correct data is a struggle.

Another fact revealed by this research is that 82% cannot point out trends in their products among the packaging industries. This is mainly due to the fact that almost a third of these industries use manual systems to identify problems or monitor their KPIs. Almost half of the sectors control the equipment downtime manually, with the operators filling in the data.

PackIOT comments on monitoring OEE goals of the factories

The study carried out worldwide by PackIOT also shows that two out of three companies do not have the means to monitor and track their factories’ productivity and OEE goals in real-time. Half of the industries only have access to this information at certain times.

The OEE (Overall Equipment Effectiveness) is one of the main metrics that allows monitoring the equipment performance, as it analyzes equipment availability, performance, and quality. It is noteworthy that industries that use cloud-based solutions, 63% of respondents, have better control of their factory’s production metrics, such as OEE, setup time, and wastage rates, compared to industries that do not use cloud solutions. These responded that they use manual processes for data collection in a proportion four times greater than companies with cloud solutions.

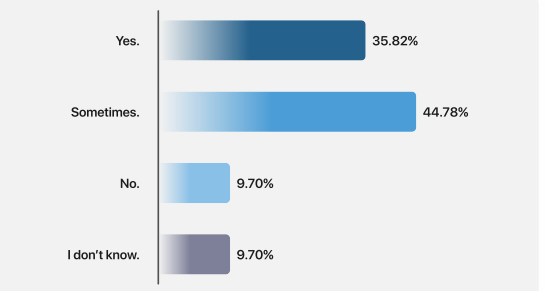

Another relevant point is that only 35% of companies can guarantee that they are reaching productivity goals. Just over half of packaging factories can respond, using the tools and systems they have in their factories, to how their production is running at that particular moment. On average, nearly two out of three factories do not know when peak production is. The best shift occurs when the highest scrap rate and whether they are on schedule for planned downtime.

The Digital Maturity Survey in the packaging industry revealed that more than half of the factories still use spreadsheets (such as Excel) to analyze data. One in four industries collects data manually. Real-time data can help your packaging plant to have better people management, new business opportunities arising at the right time, better decision making, and quick responses to alerts. Despite this, only 18% of industries collect data across the entire shop floor, and nearly 30% have real-time data available.

“Everyone is talking about Industry 4.0 today. Many agree that this should happen, but few know what this expression really means or even know where to start. To help us better understand how the packaging industry is doing within Industry 4.0 and digital transformation, we have developed our new Digital Maturity in the Packaging Industry study”, says PackIOT chief executive officer Cristiano Wuerzius.”

“While moving towards digital transformation may seem difficult, there are simple steps the packaging industry can take and prepare to experience Industry 4.0. Chief executive officers, plant managers, shift leaders, and operators can now create the right environment for success.”