When we visited Canpac in April 2018, it was in the course of significant expansion in several areas in its Ahmedabad mother plant and buying its second K&B multicolour carton press to be installed there. The expansion was in several areas –– the plant itself that was to have a new packaging design area, while the flexible packaging with a new Bobst gravure press, a Nordmeccanica laminator, Kalpravux slitter-rewinders, and fully equipped infrastructure for luxury cartons (rigid box) manufacturing were already installed.

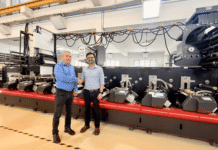

The owner and driver of the expansion, Nilesh Todi, talked about the soon to be installed K&B 7-color coater UV press on order, and paper bag making machines lines from Italy and China that had already arrived in the plant and were awaiting installation. The first K&B 7-color coater UV press was already running in its just established Tirupur plant. In addition, he mentioned the purchase of several trucks that the company would use to deliver the various packaging products produced under one roof for each brand owner customer to its doorstep.

Todi’s ideas sound workable, except that most expansion plans in India are serial at best – one thing after another. It is almost impossible to execute or realize several ideas or plans in parallel, which he took on successfully. The compression of time is every Indian’s dream and even with the appropriate resources, the complexity of executing any plan on time is beyond most industrialists – when an expansion or Greenfield project is completed on time it is something that they rightfully boast about.

Canpac’s ambition of reaching a turnover of Rs 400 crore on the back of five multicolour carton presses in two locations has not really arrived on its estimated schedule of three years – because of the unforeseen Covid-19 pandemic, it will be delayed by a year. But the execution has been relatively neat considering the competitive influx of carton presses and converting equipment, the flattening of the economy and finally, the pandemic lockdowns.

The completion of the Ahmedabad building, the expansion of the carton, flexible packaging, paper carry bag, rigid box, design and trucking solutions have more or less happened. Moreover, there has been an infusion of capital by JM Financial, a private investment firm, and growth fund to the tune of Rs 60 crore for a minority stake in the company. This was primarily to establish certain SOPs, induct professional management and leverage quality human resources.

“The Rs 400 crore target is now postponed to 2022-23 – 70% in folding cartons but at the right time we will grow the other businesses,” according to Canpac’s managing director, Nilesh Todi. He explains, “Every new carton line should produce about Rs. 45 to 50 crores, ideally.” He adds that the higher numbers include some of the nominal inflation in the industry – particularly in raw material prices. “Last year’s growth and business development was disrupted by the Covid 19 pandemic and its lockdowns. The Rs 700 crore turnover target is for 2026 now.”