India’s organized paper packaging is likely to sustain its growth momentum, with revenue printing 14-16% higher this fiscal after about 35% growth in fiscal 2022, which, in turn, was on a low base created in fiscal 2021 by the impact of the first wave of the pandemic, a report by Crisil published this month said.

This revenue growth, which will be volume-driven, will push up utilization levels of players to near-optimal levels, spurring capacity addition via de-bottlenecking and new plants.

Realizations may see only a nominal revenue increase this fiscal with key input prices stabilizing. This, along with the benefits of price hikes in the last fiscal and higher operating leverage, will drive up operating profitability by 100-150 basis points (bps) on-year to about 17-18% in fiscal 2023. Better cash generation will support phased capacity addition plans, keeping credit profiles stable, Crisil said.

A Crisil Ratings analysis covering 48 paper packaging companies with aggregate revenue of about Rs 21,000 crore, or approximately 40% of the industry, indicates as much.

Paper packaging accounts for a dominating 55-60% of the paper sector’s capacity, followed by writing and printing paper (about 25%), newsprint (about 10%), and specialty paper and other segments. It comprises paperboard and kraft paper used in pharmaceutical, e-commerce, consumer durables, fast-moving consumer goods, and apparel sectors.

“Continued strong demand from the eCommerce, apparel, and consumer durables segments, and the ban on single-use plastic, will lead to a healthy volume growth of 10-12% revenue this fiscal on the back of 25% notched up last fiscal. The ban on single-use plastic will have a stronger impact in certain product categories, primarily in food and beverages,” says Anuj Sethi, Senior director, Crisil Ratings.

Better utilization amid healthy demand

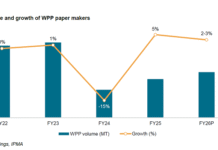

Amid sustained healthy demand, utilization is expected to rise past 85% this fiscal compared with about 77% last fiscal. Companies are undertaking debottlenecking and productivity improvement measures to raise capacity in the short term. New plants will also follow, and overall industry capacity is seen rising 10% by fiscal 2025.

The prices of the key raw material – domestic and imported waste paper – have stabilized after peaking in March-April 2022. Domestic waste paper prices rose from about Rs 20,000 per tonne in March 2021 to Rs 28,000 in March 2022, but have since declined to about Rs 21,000 in August 2022 with a resumption in waste paper collection activity. On the other hand, the prices of imported pulp, a lesser-used raw material, have been continuously rising in the last three fiscals.

“Three factors — stable waste paper prices, higher realizations, and better operating leverage — have offset the impact of costlier power, fuel, and freight. As a result, the operating profitability of packaging players is expected to recover to the pre-pandemic level of 17-18% this fiscal. Healthy cash generation will ensure debt metrics remain comfortable, keeping credit profiles stable,” says Aditya Jhaver, director, Crisil Ratings.

Crisil expects interest cover of paper packaging companies in the Crisil Ratings portfolio at about 10.3 times, and their ratio of debt to earnings before interest, tax, depreciation, and amortization at about 1 time this fiscal, compared with 10.6 times and 1-1.1 time, respectively, last fiscal.

Continued healthy prospects and revenue generation along with phased capacity expansion will ensure debt metrics remain at comfortable levels over the medium term, it said.

“Inflationary headwinds and a movement in the prices of key raw materials such as imported waste paper and pulp, and currency will bear watching,” Crisil concluded.