The German film machine manufacturer Brückner closed the year 2020 with good transactions on the Indian subcontinent, in Southeast Asia and China. What is the market doing? What are the customers’ priorities in Asia? We asked Reinhard Priller, Brückner’s Director of Sales. Susanne Bluml reports.

Packaging South Asia: Business development in Asia has long been linked to high expectations at Brückner. What are the results for the past year – especially when considering the pandemic situation all over the world?

Reinhard Priller: We have slightly exceeded our growth forecasts! Asia, and China in particular, is the most dynamic market worldwide. Especially in times of the pandemic, the importance of safe food has increased and, as a result, there was strong demand for machines and systems that contribute to food packaging and food safety. Of course, the processes for sales were more difficult, but we were still able to continue sales talks effectively with the help of digital media.

What will happen in 2021?

We see no reason why the current situation in Asia should change. The population is growing and expanding the middle class. This is clearly visible in China. Of course, in our business a stormy development also leads to slower investment phases – as we saw around 2010, for example. We expect the same to happen this time, but not before 2022 and 2023.

And how do you currently assess market developments in India?

India has developed in a comparable way to China in recent years and shows potential for strong growth in coming years. India is also showing growth of the middle class, but at somewhat lower rates compared to China. The middle class in India also wants to afford modern products. This, in turn, is driving consumption of high-end packaging. We have seen a very dynamic development in India for three to four years. This has had a positive impact for us in 2020. It is also very interesting that we are involved in very promising talks in Pakistan, which has not stood out with stormy investments so far. We have already signed contracts there.

However, it has to be said for the whole region that the time needed for financing is slightly longer than in China. This has to do with the fact that – I suspect – the banks may not be able to provide such strong support. We also work with Hermes-covered financing there. It’s a win-win situation – as a German supplier, we can do business with the Indian subcontinent and Pakistan, and the local partners get German quality machinery.

Which film variants are in preferred demand in India and Pakistan?

In these markets we are mainly talking about packaging films. In India in particular, megacities with populations of well over a million people have to be supplied. This is why there is an increasing demand for equipment in the packaging sector. In India, the focus is classically on polyester films. But we see a trend towards polypropylene films, i.e. films made of polyolefins. Worldwide, about two thirds of all biaxially oriented packaging films are made of polypropylene, one third of polyester. In India it was the exact opposite for a long time, but the Indian market is slowly approaching the world market.

Of twelve lines you sold to India last year, eight are for polyethylene applications. What does that mean in terms of sustainability – especially when these PET lines are used for multilayer applications and thus the material has to be routed to downcycling?

We have to check the entire supply chain: from the raw material to the final packaging for the consumer and back to the raw material producer or the converter who produces the film or tray. Collection systems have to be set up. Then the product range needs to be examined to see how recycling can be done from these collected products. In supermarkets we see a lot of packaging made of aluminium, paper and plastic. These multi-material structures are not so easy to recycle, that is correct.

If we look at pure plastic film – biaxially oriented or non-oriented – laminates are often produced after the stretching process. Non-oriented films are laminated with oriented ones to create properties such as puncture resistance. In addition, printing or lamination must be taken into account.

We bundle the topics around sustainability at Brückner under the slogan ‘Yes we care.’ The trend is to reduce the material mix and the number of materials used in the finished product. The use of pure polyester or pure polyolefin would facilitate recycling. The big economies like India or China are thinking very carefully about what they will do in the future. Among other things, a collection system has been introduced in larger cities in China to collect certain products in a classified way.

How flexible are your customers when it comes to film design?

Our clients try to be very flexible. The asset investments are designed for lifetimes of 15 to 20 years. So the customer has to know that he can react to market conditions. In the field of polyolefin film, Brückner gave the impetus several years ago to use inline coating technology to avoid further processing steps and to apply only ultra-thin functional layers that do not interfere with recycling. These technologies can be prepared in advance in line planning without doing the investment completely.

Another example: Two years ago we launched a hybrid line concept for PP and PE polyethylene films. Here the customer can produce the classic PP film, but the line is already prepared to produce PE films. PE films offer properties that make it possible to avoid material laminates.

It has to be said clearly that the decision to use these solutions lies with the market. I certainly have a “sustainable heart” and like to support such decisions from the sales side. But ultimately it is the market that decides.

Does an Indian customer have to invest more in the preparation of such an upgrade – if the upgrade is done later?

At Brückner, numerous specialists support our customers in this decision. This can be pre-equipment so that the machine is a little longer to dry the applied coating liquid or to produce even better structures for mono-materials already in the extrusion process. Then it is up to the customer to decide whether he can already launch such innovative products in the market. The pre-equipment may well mean additional investment of 10 to 15%, depending on which options are already planned in advance. A customer being faced with price pressure will think carefully about which options to pack into the machine.

How many customers from the Indian market bought these preparations in their machines in 2020?

About 10% of the lines in our new deals have pre-equipment for inline coating or options for mono-material extrusion. But our lines can be equipped with upgrades during their lifetime, adapted in performance or even in the complexity of the manufacturing process. This is a part of our business at Brückner Servtec that should not be underestimated. About 30% of the business there concerns adaptations and retrofits of existing plants.

Do you see that the issue of sustainability is gaining more attention in sales talks?

For the last three to four years, we have noticed that the Paris Agreement on climate protection is making a difference. Society and our customers are dealing with the issue. We are discussing specific solutions intensively and our customers are asking specific questions: Where is the journey going? Towards mono-material structures or towards biodegradable materials? Do we aim to use petroleum-based products in the future or products made from renewable raw materials? The discussion has turned more and more diverse. When it comes to sustainability, customers often take a pragmatic approach and ask: What is environmentally friendly? In recent years, investments have been made in high-performance packaging film lines that are equipped with energy-saving systems: Energy-saving and heat recovery systems are integrated in the stretching oven. The new generation of lines integrates direct drives and energy-saving motors to produce the biaxially oriented film in the most energy-efficient way.

Comparing your machines currently on the market with machines from ten years ago, to what extent have you been able to reduce energy consumption?

In relation to the kilogram of stretched film, our machines have certainly been improved by 30%. On the one hand, this is due to larger machines that also produce more economically and, on the other hand, to improved technology.

And what is possible in terms of material?

Through better material utilization and better material properties, especially in terms of tensile strength, we can also tend to produce thinner films. We are moving in towards film qualities of less than 20 µm and thus also generate less waste. This provides a double benefit – less primary material is used and less energy input is required, as correspondingly less material has to be stretched and heated and or cooled.

What developments are currently in the pipeline at Brückner that are interesting for the Asian market? Especially in the current phase of very limited trade fair activity.

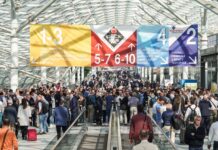

We are present at trade fairs! With our hybrid trade fair concept, colleagues are physically on site at the trade fair stand and via meeting rooms, also at our headquarters in Siegsdorf, we can reproduce the meeting situation very well. The first big acid test will now take place in April at Chinaplas – one of the leading trade fairs in the plastics industry. A trade fair is still a good forum to talk about customer needs and present our solutions.

What solutions will you be showing there?

We still have some ideas for the packaging market to reduce energy consumption. Furthermore, we would like to push our BOPE/BOPP hybrid lines: We have also produced films in our pilot plant that have been processed into packaging. At Chinaplas we will present the basic film, and possibly also a few packaging samples. So Brückner is not only pushing research and development for machines, but also for films.

In terms of technology, we offer a sliding chain system for polyester lines as an alternative to a roller chain system. Sliding chain systems are state of the art on BOPP production lines. In polyester production, the roller chain is currently predominant. The sliding chain as an alternative requires less maintenance and allows higher speeds.

What structures do you use in Asia to serve customers?

We have set up teams for the regions at our headquarters. China, our largest Asian market, is covered by its own sales area; the other sales areas comprise the Indian subcontinent, Southeast Asia as well as the Middle East and Africa.

We have been locally present in these countries since the mid-1980s and have our own sales offices over there. In India, we employ two engineers for sales and service near Mumbai. In China, we are represented by two sales offices, one in Hong Kong and one in Suzhou, near Shanghai. Of course, we also offer service there, with six people in service. Our third country base in Asia is in Jakarta, Indonesia, where we serve our customers with one sales employee and four service employees.

Thank you, Mr. Priller, for this comprehensive overview.