Manroland Sheetfed Division revenue: €203.5 million. (2018: €259.8 million). Orders on hand: €61.2 million. (2018: €27.4 million). Headquarters: Germany. Employees: 1,472.

In the year to 31 December 2019, the Langley group recorded revenues of €820.2 million (2018: €848.4 million). It generated a profit of €59.9 million (2018: €103.5 million) before tax and non-recurring costs of €4.1 million (€2018: nil) associated with the acquisition and subsequent reorganization of Marelli Motori, the Italian electric motor and generator producer, acquired by the group in May.

Profit after tax for the year was €41.7 million (2018: €73.8 million), and there was a shareholder dividend of €90.0 million paid in April (2018: €nil). At year-end, the consolidated cash balance stood at €238.9 million (2018: €379.5 million), and net assets were €707.4m (2018: €722.6 million). The group had nil net debt throughout the period (2018: nil), and orders on hand at year-end were €254.3 million (2018: €208.4 million).

Chairman AJ Langley’s review of Manroland Sheetfed in the company’s annual report for 2019 states, “The first two quarters of 2019 saw particularly aggressive competitor behavior in the market, as supply continues to exceed demand in the sector. Hitherto I was content for the business to principally serve its installed base. However, order intake was substantially impaired in the first half, and in July, I gave license for the business to respond in the market ‘gloves off.’

“Order intake improved significantly in the second half and new orders for printing presses in the last quarter more or less equaled those of the first half, albeit at lower margins. Unfortunately, it was not possible to translate sufficient of these orders into revenue in 2019, and subsequently, the factory under-recovered for much of the year, working short time until November.

“However, the order book is now at a healthy level with production at its highest level since we acquired the business in 2012. At the current run-rate, the division is contributing positively again, and I have instructed the business to continue with the ‘gloves off’ initiative.

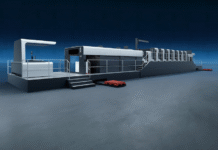

“The Manroland business has a lower cost base and, in contrast to its competitors, is saddled with neither debt or disproportionate overhead costs. The company’s presses are highly regarded in the market, and Manroland’s reputation universally recognized and the shareholder is patient. . . During our stewardship of the company, investment in product development has continued unabated, and 2019 was no exception. In 2016, the company unveiled its Roland 700 Evolution press, developed entirely during our stewardship and formally launched at Drupa [2016], is now widely regarded as ‘best in class.’ The company will [or planned to] unveil its latest offering to the market at Drupa 2020 in June this year.

“During the year, the second phase of alterations at Senefelderhaus, the former Manroland AG headquarters, located in nearby Mülheim, were completed. Manroland’s apprentice training facility has been relocated to the factory site.

“Investment in apprentice training at Manroland has continued unabated under our eight-year stewardship. As with all of our businesses, our perspective on Manroland is long term and it takes time to train the necessary skills to build these highly sophisticated machines. Finally, during the year, a contract to sell approximately 15 hectares (37 acres) of surplus land for development became effective. Preconditions to the sale contract were all finally met in 2019, and circa €19 million of cash is expected in March 2020.”

Production line running at full capacity

“Our production line in Germany is running at full capacity at least till next March.” That’s the positive declaration made by the CEO of Manroland Sheetfed, Rafael Penuela, as he thanked customers a few months ago, for their worldwide for their support, as evidenced by the keen interest in the company’s high-performance presses. “Our factory has been very busy with fulfilling the orders,” said Penuela.

“Manroland Sheetfed subsidiaries, together with our headquarters, are working hard together to reach more deals and be of better service to our customers,” Penuela added, “We also offer our highly competitive printing solutions to help them achieve sustainable profitability. Our efforts have been paying off.”