It has been often said that packaging should act as a silent salesman for the product, promoting the product at the point of sale. Visual cues and graphic design can only work if the package’s technical and structural design have done their job. The information on the label must be correct and conform to the legal and environmental requirements of the target market. Additional information – including the product quality and the way it was produced – can also be conveyed through the packaging.

Packaging used for food is often very different from that of non-food products or industrial packaging. Packaging for food has to be compatible with the food product packed within, and food standards and regulations must be met. For instance, the migration of harmful substances from packaging material in direct contact with food must be avoided. Thus, materials used for food packaging, handling and storage must be chosen accordingly.

A healthy habit

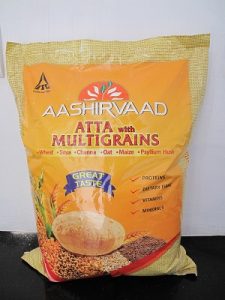

There is little doubt that more and more modern Indian consumers are opting for healthier food habits. Trends in the retail malls reflect the general upswing in the consumption of healthy food. An interesting point to note is that all these healthier food options generally cost a bit, if not a considerable amount more than the regular options. For example, a popular brand of packaged atta available in India is Aashirvaad from ITC. Apart from the regular variety which costs about `140 for five kilograms, the new multi-grain variety which comes along with a host of healthy additives costs around `100 more. A normal pack of a kilogram of Tata Salt costs about `17 whereas the healthier Tata Salt Lite costs `27.

Even, in biscuits which have always remained an integral part of our food habits, the overall transformation of the entire industry towards providing newer varieties along with distinctive packaging has been quite intriguing to watch. Consumers have never had it so good before with the current range of biscuits compared to the days when the choice would have been limited between the humble Marie or the thin arrowroot. For example, biscuits are now readily available with flavours such as chocolate, cashew, almonds, butter and cream, to name a few. Even sugar free or biscuits are now available for health-conscious or diabetic consumers who are willing to shell out a bit more.

Stand-up pouches

Over the last few years the stand-up pouch has emerged as one of the most versatile and rapidly growing flexible packaging formats that is being adopted for an increasingly wide variety of end-use applications. More generally, stand-up pouches offer packers an opportunity to stimulate packaged food sales, develop creative ways to compete better at the consumer and retailer, and the ability to offer profitable and innovative value-added line extensions to brand owners that complement their core businesses. Clearly, the stand-up pouch is set to become a serious rival alternative to rigid formats especially as packers replace existing ageing filling equipment. Snacks giants such as Haldiram’s and Bikano are now offering stand-up pouches for their popular snack products.

Shelf-life

According to a study conducted by ITC, ideally, shelf-life studies for up to two years should be conducted. However, quite often packaging technologists can use accelerated ageing analysis and their experience to predict performance. In accelerated testing the product is packed and subjected to accelerated storage temperature and humidity conditions then examined periodically.

However, this requires considerable care. “Under-staffed labs with inadequate test facilities can make mistakes. Experience gained with previous designs may no longer beappropriate. For example, printed materials may no longer be acceptable if new inks or laminates are used, or if there are new designs. There have been cases in which ink change caused residual solvents in very minute trace quantities to migrate into the food product and impart an off-flavour. Delamination may even occur if there is an increase in print although other design conditions remain the same,” the study says.

Legislation

Legislation on packaging materials is a complex and specialized topic due to the development of new food products and packaging materials. For example, the issue of migration is a critical factor in processed food packaging. The packaging material may absorb low molecular weight components providing flavour to the food but there may also be detrimental migration from the packaging material to the food product. Overall, FSSAI (Food Safety and Standards Authority of India) is responsible for protecting and promoting public health through the regulation and supervision of food safety in India and have laid down the standards which all the packaged food suppliers need to follow.

Logistics

If several modes of transport are used for export, as is often the case, all the packaging must be designed to endure the toughest stages of the distribution chain, including the number of shipments and other handling operations. Many transport modes also have their own package-marking requirements to ensure that packs are correctly handled and safely delivered. Particular product groups such as perishables, fresh fruit and vegetables often have specific requirements in addition to internationally accepted markings.

Packaged food in India has come of age. The growing market for packaged food provides both opportunities and challenges to food processors, importers and food packagers to respond to consumers’ requirements. Innovations in food product development and packaging are becoming key factors for survival across the world. Therefore, product packaging and accurate labelling have many important roles to play in the emerging market environment. However, as the recent debacle with a major multinational food product has highlighted, packaged food producers need to be careful in the future so as to meet the guidelines for both the package, the accuracy of information or claims as well as the food inside.+