The year 2008 could justifiably be termed the “horribilest” in recent memory for corporate finances and market capitalisation. According to an estimate, some US$ 14 trillion was wiped off world share values during the year and many venerable institutions and so-called bulwarks – especially financial companies – bit the dust, went broke or had to be resuscitated with financial sops and/or massive doses of injection of government funds. As measured by the MSCI index, global stocks declined by a record 44 per cent during the year.

Crises engulfed both the Americas and Europe in equal measure. Apart from the well-documented woes of the US economy, the resultant domino effect on the rest of the world was equally catastrophic.

The London FTSE 100 share index plummeted by 31.3 per cent during the year, its worst annual decline since it was created in 1984. It eclipsed the previous low of 24.5 per cent in 2002, the year of the dotcom bust, by an incredible 28 per cent. Not that the rest of Europe fared any better! The drop in the indices of other bourses were even more massive with CAC 40 in Paris falling 43 per cent, Germany’s DAX 30 by 40.4 per cent, Italy’s Mib 30 by 48.5 per cent and Spain’s Ibex 35 by 47.5 per cent.

Even booming economies like China, India and Russia witnessed a veritable bloodbath in their respective stock markets. Russia had the dubious distinction of being the world’s largest loser with the benchmark RTS index dropping by a whopping 72 per cent and Chinese stocks, which had seen a growth of more than 300 per cent over 2006 and 2007, fell by as much as 65 per cent during 2008.

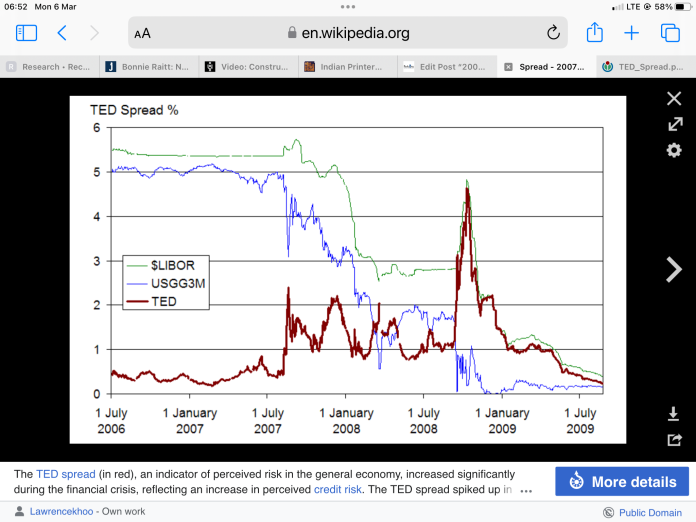

On the one hand, the first two and a half quarters of the year saw unprecedented inflation in most parts of the world driven by soaring prices of energy, oil, food and commodities but, thereafter, oil prices crashed as dramatically from a high of US$ 149 a barrel in July to under US$ 40 a barrel at the end of the year and many developed countries actually lapsed into recession in the wake of a global economic meltdown and a severe credit crunch.

The valuations of many businesses, particularly major packaging inputs like plastics and petrochemicals, metals, paper/paperboards and glass actually hit unviable levels leading to wide-scale curtailment of production and even permanent shuttering of unviable plants and capacities with concurrent manpower reduction.

An unusual fall-out of this has been the collapse of some major mergers, alliances or takeovers announced in late 2007 due to severe erosion of stock values in the interim. We have written about two such major setbacks (Dow Chemicals/Kuwait Petroleum and Hexion/Huntsman) in this newsletter.

Can the packaging industry survive the global economic crisis? I believe it will although, in the process, there will be a bruising churn with inefficient, high-cost and less-than-nimble manufacturers falling by the wayside.

Even in the past, in periods witnessing the severest of downturns and GDP recession, the Packaging industry has posted positive growth. After all, people still have to eat and purchase essential consumer products; in fact, one earlier US study showed that, in difficult times, people tend to stay home more and eat out less, actually leading to an increase in the demand for packaged products.

True, some segments – like luxury products, white goods and non-essential lifestyle products – will be hit and there will also be a drift towards cheaper and lower value brands or brand variants. This could reflect in sales values coming down but absolute numbers of packages sold will actually grow in line with population growth and demographic dynamics like numbers of households, nuclear families, working women, disposable incomes/income distribution and middle-class aspirations.

What the Packaging industry desperately needs to do is to tighten belts, cut flab, reduce wastages, become more energy-efficient, be more responsive to customer and market needs, optimise resource and finance management and, most importantly, invest in technological and process upgrades for the future.

Those who do it better than others will do more than be able to keep their heads above water – they will see off a lot of inefficient competition in the process and consolidate their market standing. Remember, in every crisis there lies an opportunity and those who capitalise on it will be the ultimate winners.