Greater Noida-based Holosafe Security Labels, a provider of labels and security solutions, plans to expand its production capacity with the addition of multiple flexo presses. The first confirmed deal is for an S3S sleeve-based flexo press from Faridabad-based Multitec, an Indian leader in flexo printing technology. Holosafe already owns three flexo presses from Multitec, which it uses for bulk operations, apart from a press from Nilpeter.

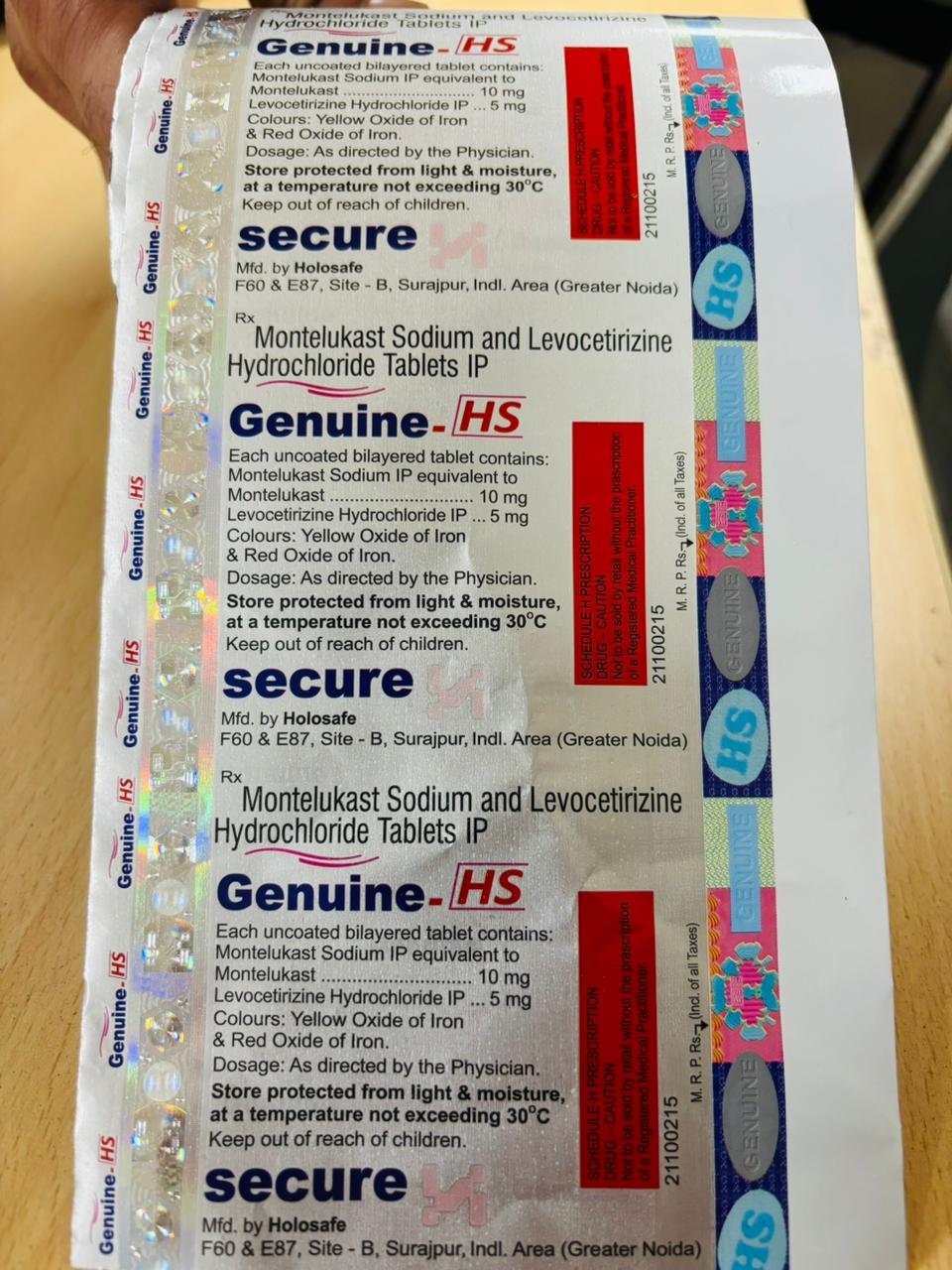

At present, Holosafe is in talks with multiple OEMs to understand which technology best suits its applications. The company has ventured into the pharma market, initially with alu-alu blister packaging, which it claims is a high-volume job. It plans to penetrate further with added capacity.

During our second visit to Holosafe’s factory in the Surajpur industrial belt in January 2026, Preeti Mishra, the company’s second-generation leadership, informed us about the growth in demand in the pharma, alcobev, and FMCG markets. Our first visit took place in May 2025, when the company installed the Jetsci KolorSmart+ digital press from Monotech Systems.

The company’s solutions portfolio comprises pressure-sensitive labels, shrink sleeves, in-mold labels (IML), paper labels, holography solutions, and static paper, serving the pharma, FMCG, alcoholic beverages, and automotive sectors, as well as the recently added blister packaging segment.

The company’s latest breakthrough is a patented dual QR code system designed to tackle counterfeiters. This system requires a user to scan an initial QR code to access a web app, which prompts the peeling off of a label to reveal a second, unique variable QR code. This multi-layered authentication ensures that even if a label is copied, it will only authenticate once, making it highly effective for industries such as pharmaceuticals, FMCG, and lubricants. Holosafe has developed software for authentication and track and trace, reinforced by its expertise in security printing.

During our discussions, Mishra emphasized the importance of flexo in the packaging and labeling industry, dubbing it a technology for scaling businesses. “Despite being a conventional technology, flexo will retain a big chunk of businesses. A start-up will not remain a start-up forever. Once they scale, they will demand more solutions, more authenticity, more customization,” she says.

The company has increased its marketing team from two to seven members, emphasizing on-ground client engagement and internal brand awareness efforts. According to Mishra, the new strategy involves educating clients about counterfeit risks rather than direct selling. This approach has shown success with clients in the NCR, who reported strong brand recall months after initial contact.

In the competitive landscape of the Indian manufacturing sector, packaging firms are increasingly turning toward advanced automation and high-end design to combat high labour turnover and narrowing profit margins, she says. Industry leaders are reporting a significant shift in strategy, moving away from labour-intensive processes in favour of sophisticated machinery that promises both higher productivity and greater precision in specialized markets such as pharmaceuticals and the premium alcobev segments.

One of the primary drivers for this technological leap is the persistent challenge of employee retention. “We have noted a recurring cycle where new hires are trained to be compliant with industry standards, only to be poached by any factory offering marginal pay increases. To break this cycle of sunk costs, companies are investing in automated systems, such as high-speed flatbeds capable of integrated die-cutting and stamping. These machines help maintain consistent output levels even as the labour market fluctuates, effectively future-proofing production,” she says.

While the pharmaceutical sector remains a high-volume cornerstone for the industry, many providers are looking toward the automotive and fast-moving consumer goods (FMCG) sectors to secure better margins. The pharmaceutical supply chain currently faces significant price suppression, with the bulk of profits being cornered by marketers rather than manufacturers. In contrast, sectors such as automotive and FMCG offer a more balanced mix of volume and value, particularly for specialized products such as shrink sleeves and long-term contract labels.

The premium liquor market is emerging as a key frontier for packaging innovation. Inspired by European trends, Indian manufacturers are beginning to pitch micro-embossing, complex foiling, and holography techniques to domestic brands. Despite being a price-sensitive market that often views such additions as unnecessary complications, Mishra argued that premium packaging is a vital sales driver.

“By bridging the gap between purchasing departments and packaging heads, manufacturers are trying to demonstrate that a 10% increase in packaging costs can lead to a significant boost in a product’s shelf appeal and perceived luxury,” she said, adding that solutions involving AR and VR can be integrated into packaging, enabling more informed choices.

Looking ahead, Holosafe is preparing for a new wave of technological integration, including the wider adoption of RFID and smart tagging. These advancements are expected to streamline logistics and enhance security for government and high-value private-sector clients. As the company plans capacity expansion of up to 30% over the next two years, the focus remains firmly on productivity and the implementation of quality-centric printing solutions to meet the market’s evolving demands.

The company, founded by Pankaj and Manjula Mishra in 2008, aims to double its turnover by next year, necessitating capacity expansion in its conventional printing and finishing sectors.