In addition to the general investment restraint on the part of many customers in the corona crisis, travel bans, lockdowns, and other restrictions significantly affected the business figures of the Koenig & Bauer group in the first half of 2020. The restrictions caused by the Covid-19 pandemic particularly impeded deliveries of the presses to the international customers as well as the worldwide deployment of the assembly staff and service technicians.

At €480.2 million, orders were 16.2% lower than in the previous year, although this was better than the sector trend for printing presses published by industry association VDMA. At €404.5 million, revenue fell short of the previous year by 20.1%. On the cost side, massive measures were taken to address the effects of the crisis, introducing short-time working from 1 April 2020 alongside other steps. EBIT improved substantially from -€34.9 million in Q1 to -€6 million in Q2. For the first half of the year, EBIT was -€40.9 million after €0.6 million in the previous year. At -€44.2 million, net earnings as of 30 June corresponds to earnings per share of -€2.68.

Despite substantially lower trade receivables and higher customer prepayments, the half-year loss and the increase in inventories had major impacts on cash flows from operating activities, which came to – €68.6 million (2019: -€96.5 million). The equity ratio stood at 32.2% at the end of June 2020.

Segment performance

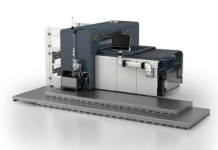

Despite the substantial gains with large-format sheetfed offset presses and folder gluers, order intake in the sheetfed segment declined by 12.9% over the previous year’s figure of €330.6 million to €288 million due to lower orders for medium and half-format presses. The revenue of €205.5 million was 20.6% lower than the previous year’s figure (€258.9 million) for delivery-related reasons, and due to the pandemic’s effects. With the book-to-bill ratio coming to 1.4, order backlog rose from €261.6 million to €265.9 million. Due to lower revenue, EBIT of -€17.4 million was below the previous year (-€1.3 million).

Order intake in the Digital & Web segment came to €56.7 million, down from €89.9 million in the previous year, due to lower orders in the web offset press business and flexible packaging printing. At €51.6 million, revenue was down on the previous year (€64.5 million). The order backlog contracted from €111.2 million to €71.2 million. The lower revenue had a significant impact on the EBIT of – €12.1 million (2019: –€10.8 million).

The decline in order intake in the Special segment from €175.3 million to €150.7 million reflects lower orders for security printing, marking and coding, and direct glass printing. In metal decorating, there was an increase in new business. Revenue fell from €204.9 million to €160.1 million. The order backlog reached €278.1 million after €316 million in the previous year. After €6.3 million in the previous year, EBIT came to -€10.3 million in the first half of 2020 for revenue-related reasons.

Outlook

CEO Claus Bolza-Schünemann stated, “In view of the high volatility and the great uncertainties surrounding the severity and duration of the coronavirus pandemic and the success of health, economic and monetary policies, the further global economic development is uncertain. Given these uncertain underlying conditions, it is currently not yet possible to issue any revenue and earnings guidance for 2020 for our group. The management board is working intensively on the Performance 2024 efficiency

program to increase operating profitability. We have applied for a KfW loan to supplement the existing syndicated credit facilities. In addition, improvements in working capital and cash flow are at the top of the agenda, together with the strategic focus on packaging printing and digital services.”