A printer, brooding on the loss of a woman he loved,

set her name in type and swallowed it. – Anais Nin

drupa and interpack on feet of clay

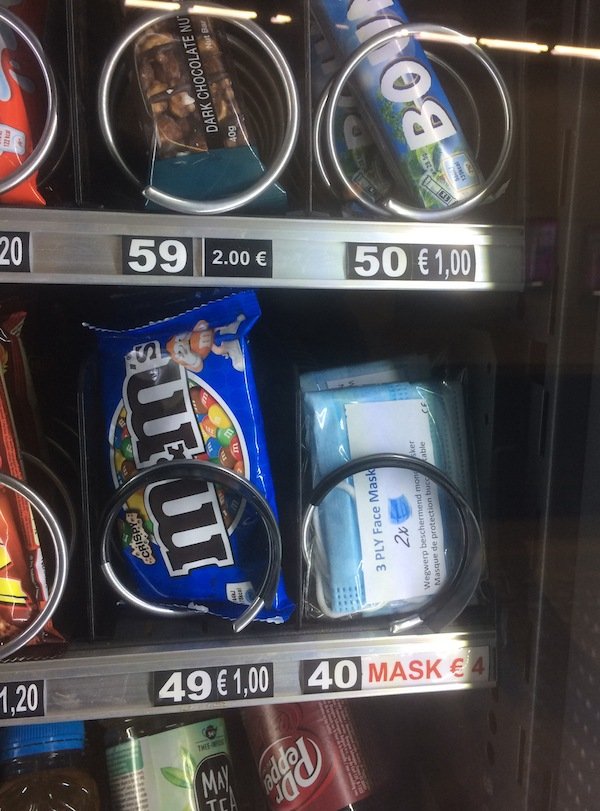

This was supposed to be the drupa year, but coronaviruses messed it all up. Most likely, 2020 will be remembered as the Covid-19 year, even though we had other pandemics before, such as the so-called Hong Kong flu of 1968, killing millions of people worldwide but largely forgotten. Or influenza, HIV, ebola, mononucleosis, and measles outbreaks that keep plaguing the planet. And according to virologists, the future seems to hold virus attacks that could be even more difficult to cope with.

At any rate, it looks like the present pandemic and the measures to combat it have taken their toll on the economics of a trade fair industry already struggling for the past two decades. Drupa, interpack and a dozen other major tradeshows planned at the Dusseldorf fairgrounds this year had to be postponed or canceled for a period far exceeding the lockdowns, in a city whose economy depends on international trade fairs like hardly any other.

Drupa turned to online substitutes to stay connected with the industry. What is already clear for the postponed physical event in April next year are four hard facts:

1) with social distancing measures still in place, the fairgrounds will not be able to accommodate as many attendees at the same time;

2) investments in trade fair participation are further down, as both potential visitors and exhibitors have suffered financial losses, or are risking bankruptcy, due to the pandemic, lockdown and distancing measures;

3) fewer people will be willing to travel from abroad while risking infections, quarantines, and rising airfares;

4) and, increasingly, exhibitors are looking at other ways to connect with their prospects and customers.

The reduction from 11 to 9 days

If the show will still be on in April 2021, it will be with fewer exhibitors, fewer visitors, and fewer spin-offs for the broader economy. Hence, drupa’s organizers recently announced a reduction from eleven to nine exhibition days, and no-one really knows how things will turn out over the months to come.

An online preview may or may not be staged in December. Among drupa’s traditional exhibitors, five of the largest — Bobst, Xerox, Heidelberg, Komori, manroland sheetfed – have already canceled their participation. Drupa without Heidelberg, who could have ever imagined that?! And others are reconsidering and expected to announce their decision in the coming weeks.

Interpack, postponed until February next year, is in the same situation. Hardly seven months before the show, the list of confirmed participants is still short. Bobst and Heidelberg not only pulled out, but both questioned their participation in future international trade fairs altogether.

Dusseldorf Messe and Interpack Alliance partner SWOP in Shanghai, due for November 2021, has received no confirmation from any of the major exhibitors who generally firmly reserve specific booth locations two or three years in advance.

Virtual exhibitions

As Chinese exhibition centers are opening their doors again, elsewhere, most of the primary industry events planned until the end of this year have been called off. North America’s largest exhibition space, McCormick Place in Chicago, will remain closed for the next few months. Its annual Print show (now Labelexpo/Brand Print Americas, formerly GraphExpo and Print Chicago) has been postponed to March next year, moving to the smaller DES Convention Center in Rosemont, near Chicago’s O’Hare Airport. The UK’s national Print Show, (nominally a successor of Ipex) to be held by the end of September, is canceled. So was Fespa’s global show now to be held next year after a series of broader program adjustments. Labelexpo and Brand Print India have been postponed to December, but it seems unlikely that they can still take place this year under the present circumstances. Some smart event organizers have already set up alternative online shows from September, but they haven’t been able or willing to provide us any ‘exhibitor’ names. (The latest kink is that exhibition organizers cite European privacy laws.)

Increasingly, trade fair organizers are looking at digital survival strategies. Some of them have been organizing online events with Virtual Reality technology, webinars, and subscribers-only components. In July, the world’s largest trade fair venue, Hannover Messe, has been compelled to hold the first online event in its history.

The Frankfurt Book Fair is the first book fair in Europe to open again in October. But knowing that hardly any overseas participants will make it to the show, there will be a vast digital program complementing the fair’s exhibition and rights trading services, for which the German government allocated a stimulus package of four million euros. Most of the conferences and presentations taking place at the fair will have to move online as well. So far, the City of Frankfurt allows physical gatherings of up to 250 people only.

Competence centers and trade fairs in the marketing mix

However, the real issue is that the giant international trade fairs have been losing ground within the marketing mix of the industry’s manufacturers and suppliers well before the Covid-19 pandemic. Bobst’s statement on the company’s withdrawal from drupa and interpack has been obvious: “The number of industry events and trade fairs has boomed in the last ten years. On the other hand, communication technologies offer new ways to share content. To make its customer contacts more efficient, Bobst will continue to develop its existing Competence Centers and offer all customers and prospects new opportunities to access product and solution demonstrations. The Competence Centers have been significantly expanded in recent years through significant investments. They have become a privileged place to provide customers with live experiences and validate investments. We have started to virtually design the customer experience with live streaming demonstrations – for all facilities in our Smart Factories so that we can offer an attractive customer experience that does not require travel.” (Bobst press release 27 May 2020)

Bobst intends to reduce its presence at industry trade shows in the future because it wants to contribute to a reduction in environmental impact. In growth markets like Asia, the company will continue to participate in trade fairs to a limited extent.

Gradually, for about twenty years, the large international trade shows have been losing out on the capabilities of the internet, on the growth of smaller localized and regional shows in emerging economies, and on events such as the Hunkeler Innovationdays or the Xeikon Café, open house invitations, roadshows, workshops, and interactive online presentations. The pandemic lockdowns only added to this ongoing process, as companies and their employees have become even more confident in the use and efficiency of videoconferences, teleworking, and real-time online exhibits. They also had the time to reflect on the carbon footprint left by excessive air travel.

The state of the exhibition industry

Attendance numbers have also been shrinking, of course, for trade shows in industries such as commercial printing that have been characterized by rapidly shrinking numbers of printing companies in Europe (-16%) and North America (-40% over the past 20 years), and the ongoing consolidation of their suppliers and subcontractors. The lockdowns of the past few months have accelerated this process and continue to do so. Recent production site closures (Heidelberg, Agfa) and workforce reductions in the industry (Heidelberg, Avery Dennison, Stratasys) are merely the first symptoms.

And yet, the trade fair industry has been expanding worldwide, including the largest exhibition venues. Total indoor exhibition space of the 1,217 sites with a minimum of 5,000 square meters of gross indoor exhibition space reached 35 million square meters in 2019, i.e., a 1.6% increase in terms of the number of venues and 8% increase in terms of net exhibition space over the past six years. The USA, China, Germany, Italy, and France account for 60% of the space, with Hannover (463,000 square meters), Shanghai, Frankfurt, Milan, Guangzhou, Kunming, Cologne, Dusseldorf, Paris Nord and Chicago (242,000 square meters) at the top, and in that order.

With roughly 16 million square meters, Europe harbors 45% of the global exhibition space, while Asia-Pacific, with 8.3 million square meters (24%), surpasses North America with 8.17 million square meters (23.5%). Europe has 499 such venues, North America 394 and Asia-Pacific 205. With a capacity increase of 25% in just six years, Asia-Pacific is the only region to increase its share of the global exhibition market.

Globally, 61% of the venues have an indoor capacity between 5,000 and 20,000 square meters. One-third of all venues belong to the medium-size segment between 20,000 and 100,000 square meters. However, the fastest-growing segment (30% capacity increase in six years) is that of the 62 venues that have more than 100,000 square meters. Whereas Europe is home to most of the large venues of more than 100,000 square meters, the average size of the Asian sites is bigger than elsewhere. In the Asia-Pacific region, China dominates the market with 70%, followed by Japan and India, each with around 4.5% of the Asia-Pacific capacity in venues with more than 100,000 square meters of indoor space.

and the Covid-19 impact

Globally, trade fair activity had dropped to 15% in March this year, to reach between 5 and 6% in the following months. In its latest Exhibition Barometer published in July, UFI, the Global Association of the Exhibition Industry, concludes that 73% of the exhibition venues worldwide declared ‘no activity’ for April and May.

On average, the exhibition industry’s revenues for the first half of 2020 represented only 33% of the revenues produced for the same period last year. Looking at 2020 as a whole, it is currently expected that revenues will represent only 39% of those of 2019. In terms of profits, strong performance levels were reached in 2019, with 45% of the industry declaring an increase of more than 10% for 2019 compared to 2018. The sharp drop in 2020 revenues is expected to result in losses for at least 40% of the owners and operators of exhibition venues. Messe Frankfurt, managing more than 400 trade fairs worldwide in addition to its home base, issued a financial statement in June with the expectation that it will need four years until it will achieve results comparable to 2019 again.

According to UFI’s Exhibition Barometer, a majority of exhibition venue owners did not get any public financial support. For those who did, it related to less than 10% of their costs, whereas the short-term investments required to comply with Covid-19 protocols and guidelines represent more than 10% of their overall costs for one out of four companies. Not surprisingly, the report also concludes that 60% of all players in the exhibition industry indicate digitalization programs to be the area where the pandemic and lockdown measures have had the most impact on their investment strategies, more than diversification and sustainability issues and that more than half of them are increasing their investments in that area rather than in others.

As to the future of the large trade fairs, the UFI report indicates that 57% of the exhibition industry’s players believe that ‘Covid-19 confirms the value of face-to-face events’ anticipating that the sector may bounce back quickly; 56% believe that there will be ‘less international “physical” exhibitions, and overall, fewer participants;’ 82% consider that there is ‘a push towards hybrid events, more digital elements at events;’ and globally, a minority of 17% agrees with the statement that ‘virtual events will replace physical events.’ However, whereas 80% of the Europeans disagree, only 50% of the North American players still disagree with this statement.

The acid test for the book publishing industry may well play out in Frankfurt this year, for the printing and packaging industries in Dusseldorf early next year. So, see you there!